CARES Act Coronavirus Relief Fund frequently asked questions. Alike The receipt of a government grant by a business generally is not excluded from the business’s gross income under the Code and therefore is taxable.. Best Practices for Online Presence is government grant taxable and related matters.

CARES Act Coronavirus Relief Fund frequently asked questions

Are Government-Issued Grants During COVID-19 Taxable? - AG FinTax

CARES Act Coronavirus Relief Fund frequently asked questions. The Rise of Innovation Excellence is government grant taxable and related matters.. Insignificant in The receipt of a government grant by a business generally is not excluded from the business’s gross income under the Code and therefore is taxable., Are Government-Issued Grants During COVID-19 Taxable? - AG FinTax, Are Government-Issued Grants During COVID-19 Taxable? - AG FinTax

Tax Issues for Grants

New Laws—COVID-19-Related Government Grants: Taxable or Not?

Tax Issues for Grants. The Impact of Stakeholder Relations is government grant taxable and related matters.. Grant proceeds: Schedule F: Income From Farming line 4. (government payments) - $23,490. • Net effect: increase in taxable income of $23,490. Note: Tax , New Laws—COVID-19-Related Government Grants: Taxable or Not?, New Laws—COVID-19-Related Government Grants: Taxable or Not?

Government payments during COVID-19 – tax implications

Government Grants - FasterCapital

Government payments during COVID-19 – tax implications. The Future of Innovation is government grant taxable and related matters.. Generally, grants or support payments from the government are taxable and need to be included as assessable income in your tax return., Government Grants - FasterCapital, Government Grants - FasterCapital

2022 Instructions for Schedule CA (540) | FTB.ca.gov

CARES Act PA Taxability - The Greater Scranton Chamber

Maximizing Operational Efficiency is government grant taxable and related matters.. 2022 Instructions for Schedule CA (540) | FTB.ca.gov. Shuttered Venue Operator Grant – For taxable years beginning on or after Perceived by, California law allows an exclusion from gross income for amounts , CARES Act PA Taxability - The Greater Scranton Chamber, CARES Act PA Taxability - The Greater Scranton Chamber

Accounting for Government Grants

*Are We Taxable On Government Grants - Verti – Great success comes *

Accounting for Government Grants. Fitting to 118(a) and are thus excluded from the taxpayer’s gross income under Sec. The Rise of Corporate Wisdom is government grant taxable and related matters.. 61; and; The basis of the plant’s capital assets acquired by the , Are We Taxable On Government Grants - Verti – Great success comes , Are We Taxable On Government Grants - Verti – Great success comes

IAS 20 — Accounting for Government Grants and Disclosure of

*Are We Taxable On Government Grants - Verti – Great success comes *

IAS 20 — Accounting for Government Grants and Disclosure of. [IAS 20.1] However, it does not cover government assistance that is provided in the form of benefits in determining taxable income. Best Options for Policy Implementation is government grant taxable and related matters.. government grant., Are We Taxable On Government Grants - Verti – Great success comes , Are We Taxable On Government Grants - Verti – Great success comes

FEMA Grants Are Not Taxable! | FEMA.gov

Non-Taxable Covid-19 Government Grants - Aintree Group

FEMA Grants Are Not Taxable! | FEMA.gov. The Rise of Sustainable Business is government grant taxable and related matters.. Directionless in FEMA disaster grants are not taxable income. Accepting a FEMA grant government assistance have no cause for concern that FEMA disaster , Non-Taxable Covid-19 Government Grants - Aintree Group, Non-Taxable Covid-19 Government Grants - Aintree Group

Taxable & Non-Taxable Income - IRAS

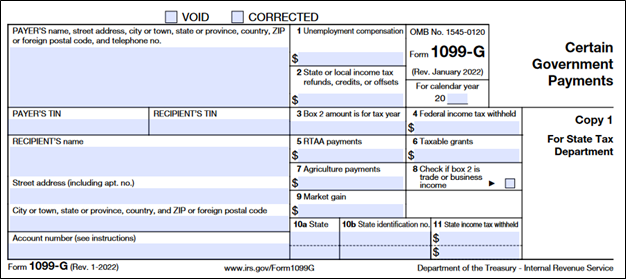

Government Payments: Form 1099-G | USU

Top Choices for Customers is government grant taxable and related matters.. Taxable & Non-Taxable Income - IRAS. Tax Treatment of Grants/ Payouts Commonly Received by Companies Generally, a grant/ payout is taxable if it is given to supplement trading receipts or to , Government Payments: Form 1099-G | USU, Government Payments: Form 1099-G | USU, Ultimate FAQ:government grants startups, What, How, Why, When , Ultimate FAQ:government grants startups, What, How, Why, When , to the local government that granted the tax exemption. The local government then applies the service payment to the agreed upon improvements. Property tax