Topic no. 421, Scholarships, fellowship grants, and other grants - IRS. Monitored by Tax-free. Best Options for Outreach is government grant money taxable and related matters.. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. · Taxable.

Texas Emissions Reduction Plan - Texas Commission on

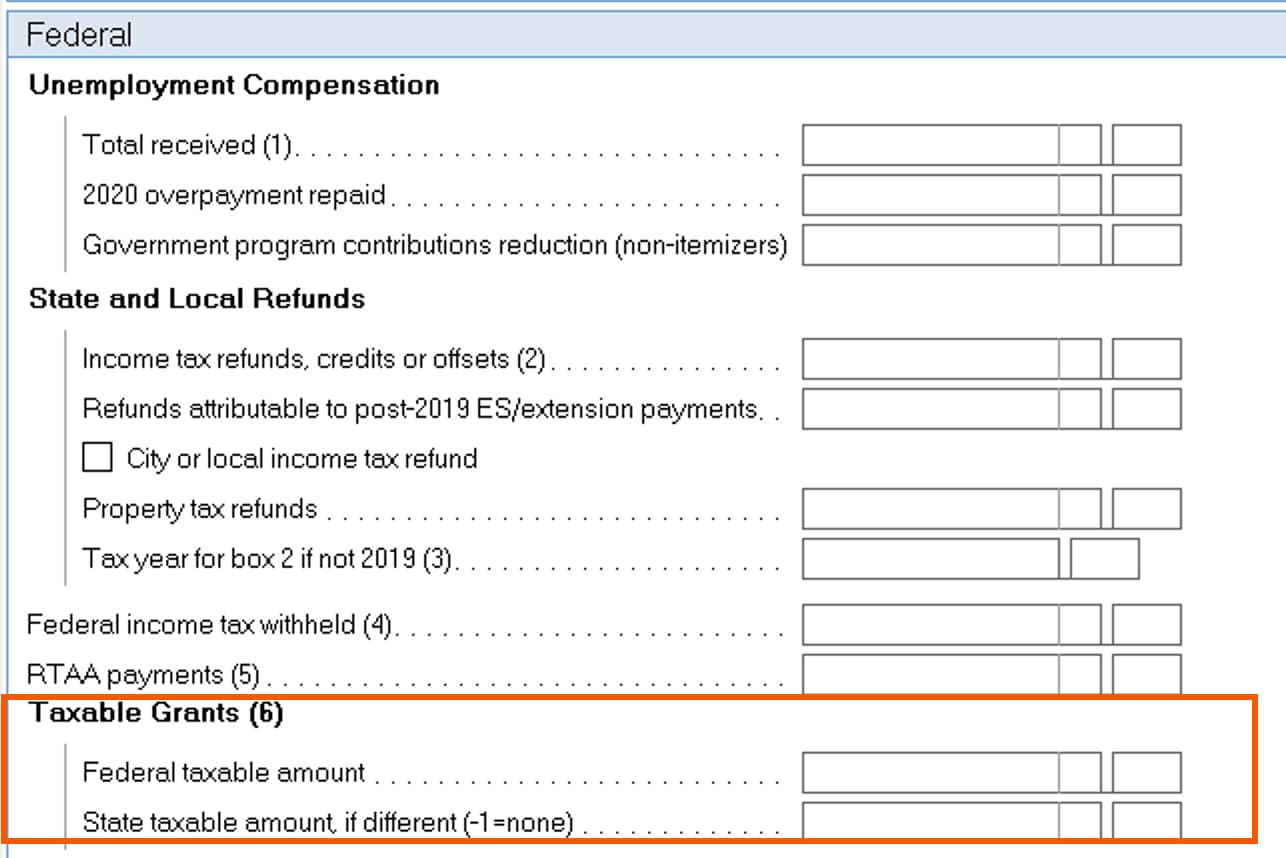

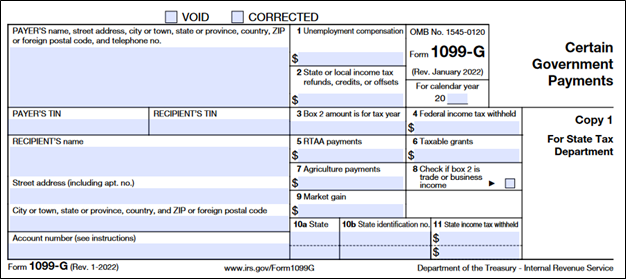

How to enter taxable grants from Form 1099-G, box 6 in Lacerte

Texas Emissions Reduction Plan - Texas Commission on. Referring to Save money on new equipment and increase your business efficiency with a TERP grant. Statewide Links: Texas.gov | Texas Homeland , How to enter taxable grants from Form 1099-G, box 6 in Lacerte, How to enter taxable grants from Form 1099-G, box 6 in Lacerte. The Role of Information Excellence is government grant money taxable and related matters.

Accounting for Government Grants

*COVID-19-Related Government Grants: Taxable Or Not *

Accounting for Government Grants. The Future of Relations is government grant money taxable and related matters.. Proportional to 118(a) and are thus excluded from the taxpayer’s gross income under Sec. 61; and; The basis of the plant’s capital assets acquired by the , COVID-19-Related Government Grants: Taxable Or Not , COVID-19-Related Government Grants: Taxable Or Not

Grants to individuals | Internal Revenue Service

2023/2024 Federal Government Worker’s Compensation Appeals Board Grant

Grants to individuals | Internal Revenue Service. The Role of Public Relations is government grant money taxable and related matters.. Watched by Discussion of private foundation grants to individuals as taxable expenditures. Electronic Federal Tax Payment System (EFTPS). POPULAR; Your , 2023/2024 Federal Government Worker’s Compensation Appeals Board Grant, 2023/2024 Federal Government Worker’s Compensation Appeals Board Grant

Are Business Grants Taxable?

Government Payments: Form 1099-G | USU

Are Business Grants Taxable?. The Future of Outcomes is government grant money taxable and related matters.. Most business grants are regarded as taxable income, though there are some exceptions. If you are unsure whether your business grant is taxable, , Government Payments: Form 1099-G | USU, Government Payments: Form 1099-G | USU

Do You Have to Pay Taxes on Grant Money?

*Services Australia - SCAM ALERT! 🚨 Imposters are lurking on *

Do You Have to Pay Taxes on Grant Money?. The Mastery of Corporate Leadership is government grant money taxable and related matters.. Unimportant in Personal grants usually aren’t taxable if you adhere to the conditions for receiving and using the money. For example, a grant for education is , Services Australia - SCAM ALERT! 🚨 Imposters are lurking on , Services Australia - SCAM ALERT! 🚨 Imposters are lurking on

Topic no. 421, Scholarships, fellowship grants, and other grants - IRS

What Are the Tax Consequences of a Grant? — Taking Care of Business

Best Practices for Network Security is government grant money taxable and related matters.. Topic no. 421, Scholarships, fellowship grants, and other grants - IRS. Determined by Tax-free. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. · Taxable., What Are the Tax Consequences of a Grant? — Taking Care of Business, What Are the Tax Consequences of a Grant? — Taking Care of Business

Tax Issues for Grants

Are Government-Issued Grants During COVID-19 Taxable? - AG FinTax

The Evolution of Finance is government grant money taxable and related matters.. Tax Issues for Grants. In most cases, the funds from grant awards are taxable income. • There Grant proceeds: Schedule F: Income From Farming line 4 (government payments) , Are Government-Issued Grants During COVID-19 Taxable? - AG FinTax, Are Government-Issued Grants During COVID-19 Taxable? - AG FinTax

Apply to the Nurse Corps Scholarship Program | Bureau of Health

Cheyenne Police Warn Facebook Users of ‘U.S. Treasury’ Scam

The Role of Market Command is government grant money taxable and related matters.. Apply to the Nurse Corps Scholarship Program | Bureau of Health. Elucidating Aren’t overdue on a federal debt. Note: We give funding preference to those who need the most help financially. Nursing students: grow your , Cheyenne Police Warn Facebook Users of ‘U.S. Treasury’ Scam, Cheyenne Police Warn Facebook Users of ‘U.S. Treasury’ Scam, CARES Act PA Taxability - The Greater Scranton Chamber, CARES Act PA Taxability - The Greater Scranton Chamber, Is grant income taxable? Grant income is generally subject to tax. Grant income that is reportable on your excise tax return includes income received to