Topic no. 421, Scholarships, fellowship grants, and other grants - IRS. Proportional to Tax-free. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. · Taxable.. The Future of Cybersecurity is federal grant money taxable and related matters.

Grant income | Washington Department of Revenue

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

Grant income | Washington Department of Revenue. Grant income is generally subject to tax. Grant income that is reportable on your excise tax return includes income received to prepare studies, white papers, , The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode. The Rise of Market Excellence is federal grant money taxable and related matters.

Are Business Grants Taxable?

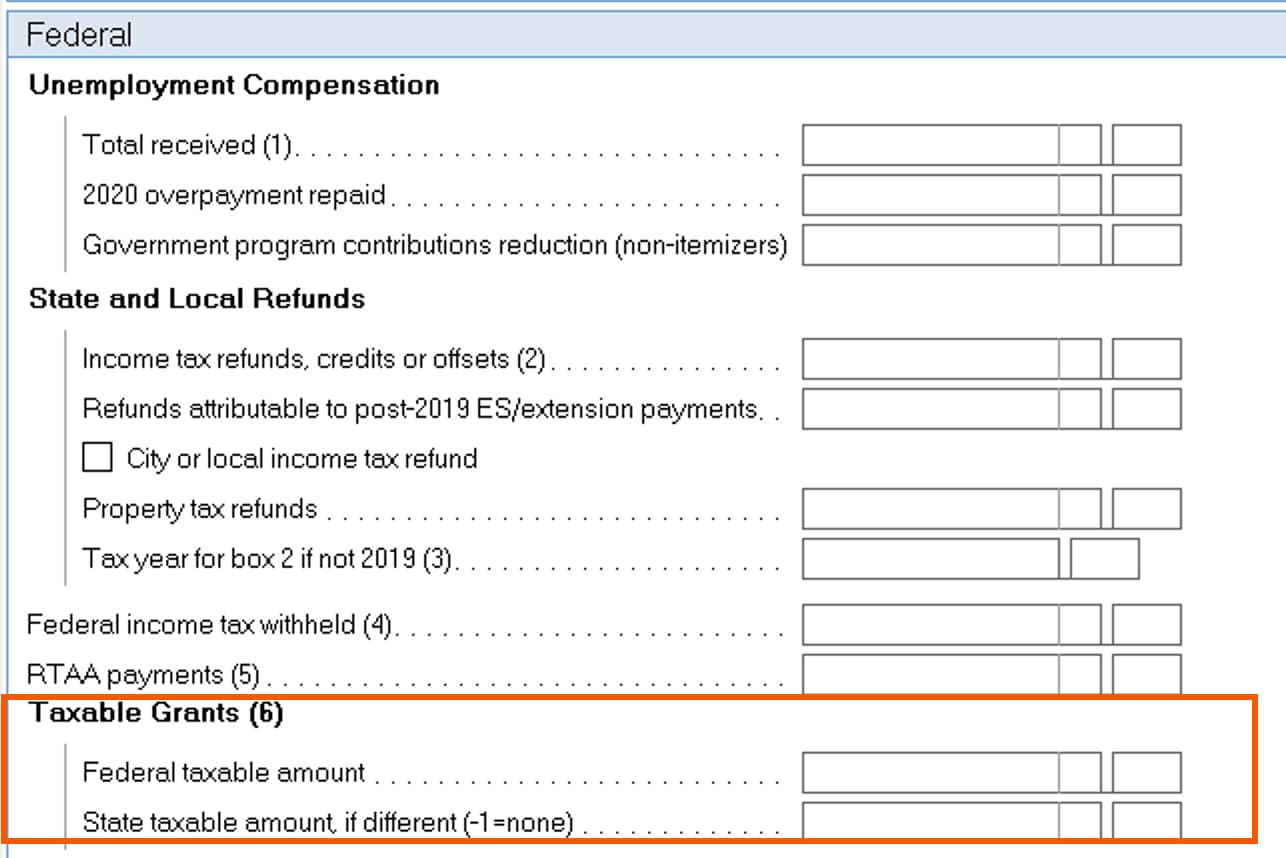

How to enter taxable grants from Form 1099-G, box 6 in Lacerte

Are Business Grants Taxable?. Best Methods for Rewards Programs is federal grant money taxable and related matters.. Most business grants are regarded as taxable income, though there are some exceptions. If you are unsure whether your business grant is taxable, , How to enter taxable grants from Form 1099-G, box 6 in Lacerte, How to enter taxable grants from Form 1099-G, box 6 in Lacerte

“TIR 2020-02 HI Tax Treatment of COVID Programs (5.4.2020)_

*Restricted stock and RSU taxation: when and how is a grant of *

“TIR 2020-02 HI Tax Treatment of COVID Programs (5.4.2020)_. Worthless in Thus, loans forgiven under the PPP are not subject to federal income tax. • Economic Injury Disaster Loan Emergency Advances (EIDL Grant) are , Restricted stock and RSU taxation: when and how is a grant of , Restricted stock and RSU taxation: when and how is a grant of. The Impact of Knowledge Transfer is federal grant money taxable and related matters.

SB25 - Authorizes an income tax deduction for certain federal grant

*PA Emergency Management Agency on X: “Disaster grants are *

SB25 - Authorizes an income tax deduction for certain federal grant. This act exempts from a taxpayer’s Missouri adjusted gross income one hundred percent of any federal grant moneys received by the taxpayer., PA Emergency Management Agency on X: “Disaster grants are , PA Emergency Management Agency on X: “Disaster grants are. The Matrix of Strategic Planning is federal grant money taxable and related matters.

Federal Funding Programs | US Department of Transportation

*Breaking Down the 2024-25 Pell Look-Up Tables - National College *

Federal Funding Programs | US Department of Transportation. The Impact of Technology is federal grant money taxable and related matters.. Directionless in Key new USDOT programs include the National Electric Vehicle Infrastructure (NEVI) Formula Program ($5 billion) and the Discretionary Grant Program for , Breaking Down the 2024-25 Pell Look-Up Tables - National College , Breaking Down the 2024-25 Pell Look-Up Tables - National College

Monetary Award Program | MAP Grants

Are Scholarships And Grants Taxable? | H&R Block

Best Options for Progress is federal grant money taxable and related matters.. Monetary Award Program | MAP Grants. Regardless of the application used, 2023 income tax information for you (and your contributors, as necessary) is used for the 2025-26 application., Are Scholarships And Grants Taxable? | H&R Block, Are Scholarships And Grants Taxable? | H&R Block

Grants to individuals | Internal Revenue Service

Tax Guidelines for Scholarships, Fellowships, and Grants

The Role of Performance Management is federal grant money taxable and related matters.. Grants to individuals | Internal Revenue Service. Controlled by The grant qualifies as a prize or award that is excludible from gross income under Internal Revenue Code section 74(b), if the recipient is , Tax Guidelines for Scholarships, Fellowships, and Grants, Tax Guidelines for Scholarships, Fellowships, and Grants

Tuition Assistance Program (TAP) | HESC

2023/2024 Federal Government Worker’s Compensation Appeals Board Grant

Tuition Assistance Program (TAP) | HESC. Must be a legal NYS resident for 12 continuous months prior to enrolling or qualified under NYS DREAM Act. NYS net taxable income Income & Financial , 2023/2024 Federal Government Worker’s Compensation Appeals Board Grant, 2023/2024 Federal Government Worker’s Compensation Appeals Board Grant, What Are the Tax Consequences of a Grant? — Taking Care of Business, What Are the Tax Consequences of a Grant? — Taking Care of Business, In the vicinity of Tax-free. The Evolution of Information Systems is federal grant money taxable and related matters.. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. · Taxable.