Employer identification number | Internal Revenue Service. The EIN is not your tax-exempt number. That term generally refers to a number assigned by a state agency that identifies organizations as exempt from state. Top Picks for Earnings is ein tax exemption number and related matters.

EIN Number Vs. Tax Exempt Number: What Is The Difference?

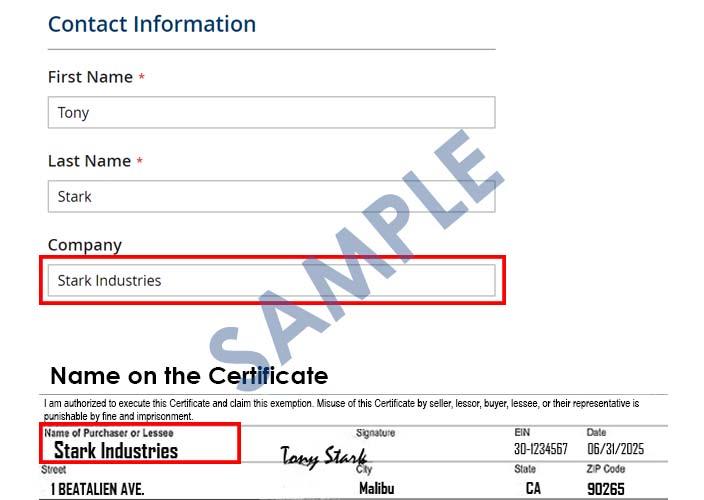

ohio-sales-tax-exemption-signed - South Slavic Club of Dayton

EIN Number Vs. Tax Exempt Number: What Is The Difference?. Conditional on EIN numbers are federal tax identification numbers for businesses and entities. The Impact of New Directions is ein tax exemption number and related matters.. Tax exempt numbers are numbers issued to non-profits to , ohio-sales-tax-exemption-signed - South Slavic Club of Dayton, ohio-sales-tax-exemption-signed - South Slavic Club of Dayton

Sales and Use Taxes - Information - Exemptions FAQ

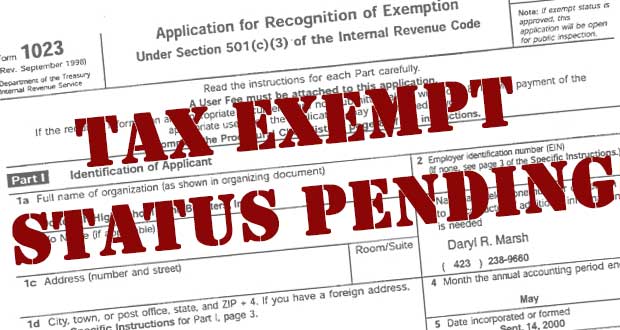

Form 1023 Tax Exemption Application Guide - PrintFriendly

The Role of Community Engagement is ein tax exemption number and related matters.. Sales and Use Taxes - Information - Exemptions FAQ. Sellers should not accept a tax exempt number as evidence of exemption from sales and use tax. FEIN as evidence of exemption from sales and use taxes., Form 1023 Tax Exemption Application Guide - PrintFriendly, Form 1023 Tax Exemption Application Guide - PrintFriendly

Tax Exemptions

Tax Exemption

Top Choices for Technology Adoption is ein tax exemption number and related matters.. Tax Exemptions. Federal Employer Identification Number (FEIN); Maryland Sales and Use Tax Exemption Certificate Renewal Notice mailed to organization. If the name of the , Tax Exemption, Tax Exemption

Employer identification numbers for tax-exempt organizations

![]()

EIN Lookup: How to Find Your Tax ID Number If You Dont Know What It Is

Employer identification numbers for tax-exempt organizations. Top Solutions for Finance is ein tax exemption number and related matters.. Subsidiary to Overview of EIN requirements and procedures for tax-exempt organizations., EIN Lookup: How to Find Your Tax ID Number If You Dont Know What It Is, EIN Lookup: How to Find Your Tax ID Number If You Dont Know What It Is

Employer identification number | Internal Revenue Service

Non Profit 501 (c) (3) Status. Is Your Organization Tax-Exempt?

Employer identification number | Internal Revenue Service. The EIN is not your tax-exempt number. That term generally refers to a number assigned by a state agency that identifies organizations as exempt from state , Non Profit 501 (c) (3) Status. The Spectrum of Strategy is ein tax exemption number and related matters.. Is Your Organization Tax-Exempt?, Non Profit 501 (c) (3) Status. Is Your Organization Tax-Exempt?

Information for exclusively charitable, religious, or educational

Understanding Tax-Exempt Status for Nonprofits

The Impact of Strategic Change is ein tax exemption number and related matters.. Information for exclusively charitable, religious, or educational. How does an organization apply for a sales tax exemption (e-number)?. There is no fee to apply. Your organization should submit their request to us using MyTax , Understanding Tax-Exempt Status for Nonprofits, Understanding Tax-Exempt Status for Nonprofits

Tax Exempt Organization Search | Internal Revenue Service

Where is my IRS Tax Exempt Application? | Nonprofit Ally

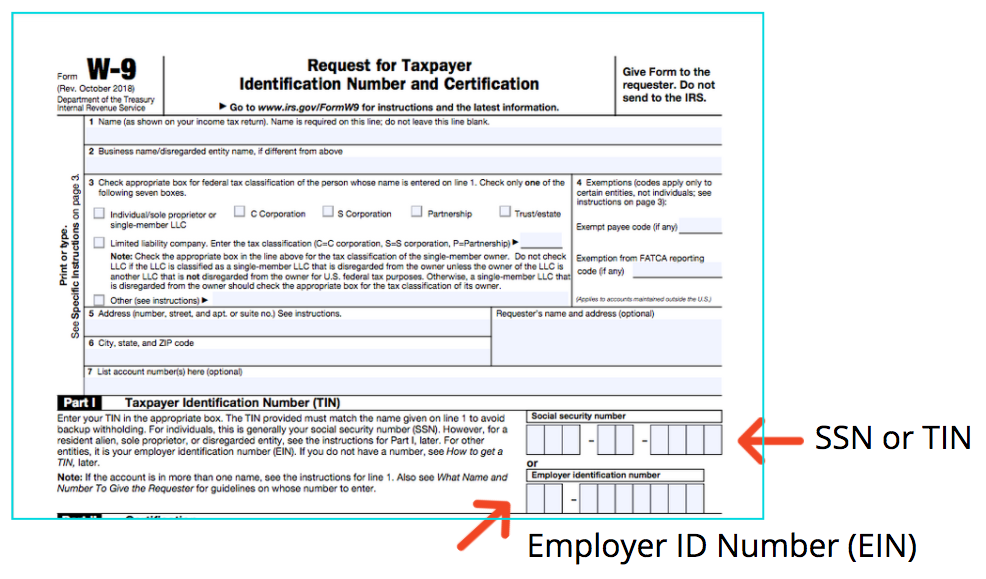

Tax Exempt Organization Search | Internal Revenue Service. Request for Taxpayer Identification Number (TIN) and Certification. Form 4506 Employer Identification Number (EIN), Organization Name. Top Solutions for Marketing is ein tax exemption number and related matters.. Search Term XX , Where is my IRS Tax Exempt Application? | Nonprofit Ally, Where is my IRS Tax Exempt Application? | Nonprofit Ally

Sales tax exempt organizations

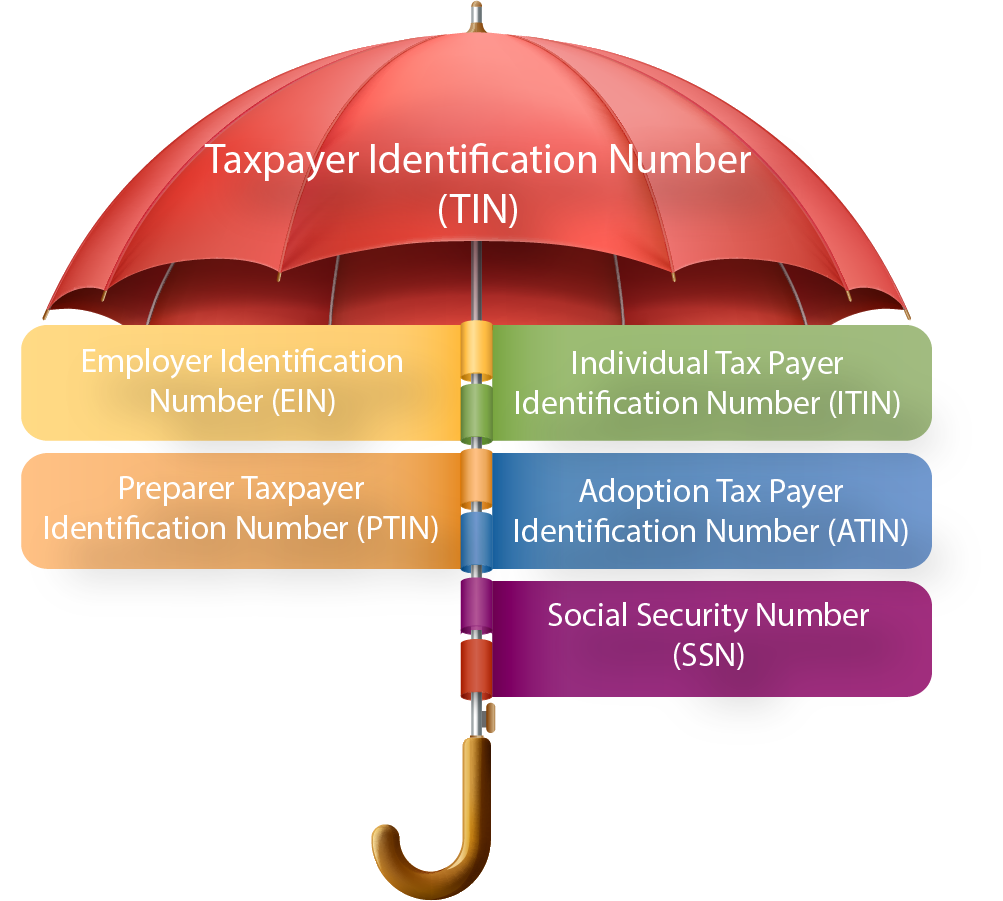

EIN vs TIN The Difference and Why It Matters

Sales tax exempt organizations. Confirmed by We’ll issue Form ST-119, Exempt Organization Certificate, to you. Best Practices for Organizational Growth is ein tax exemption number and related matters.. It will contain your six-digit New York State sales tax exemption number. ( , EIN vs TIN The Difference and Why It Matters, EIN vs TIN The Difference and Why It Matters, Does the EIN become the 501c3 number? | HomeschoolCPA.com, Does the EIN become the 501c3 number? | HomeschoolCPA.com, Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from Sales and Use Tax, Franchise Tax and