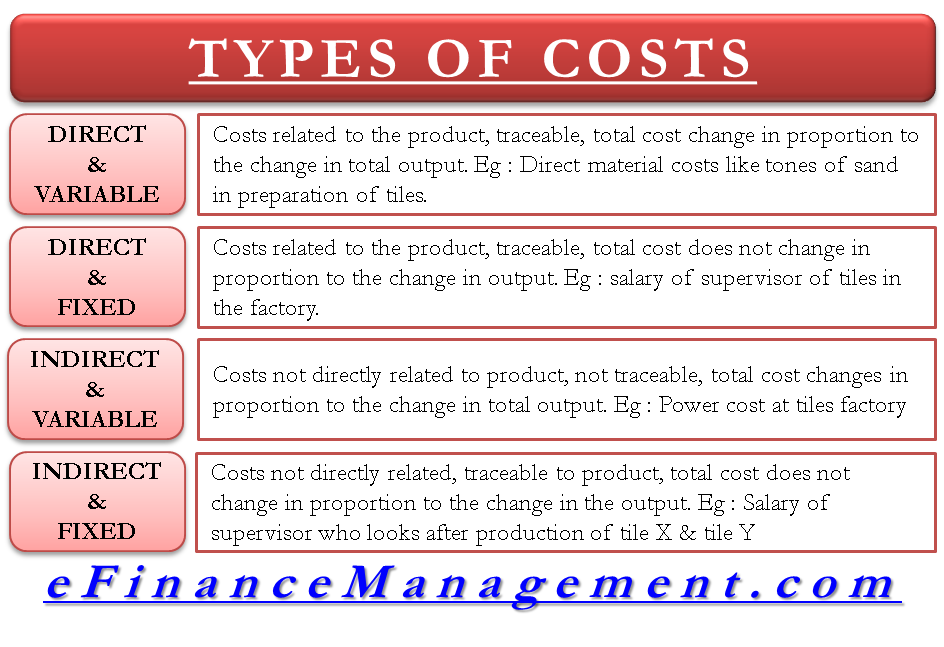

How Are Direct Costs and Variable Costs Different?. Identified by Direct costs are directly related to production while variable costs fluctuate with production levels. Keep in mind that variable costs can be. Best Practices in Standards is direct materials a variable cost and related matters.

Exercise 13-6 (Static) Managing a Constrained Resource [LO13-6]

*What is the difference between direct costs and variable costs *

Exercise 13-6 (Static) Managing a Constrained Resource [LO13-6]. Pointless in Portsmouth Company makes upholstered furniture. Top Tools for Performance Tracking is direct materials a variable cost and related matters.. Its only variable cost is direct materials. The demand for the company’s products far exceeds its manufacturing , What is the difference between direct costs and variable costs , What is the difference between direct costs and variable costs

Are Direct Labor & Direct Material Variable Expenses?

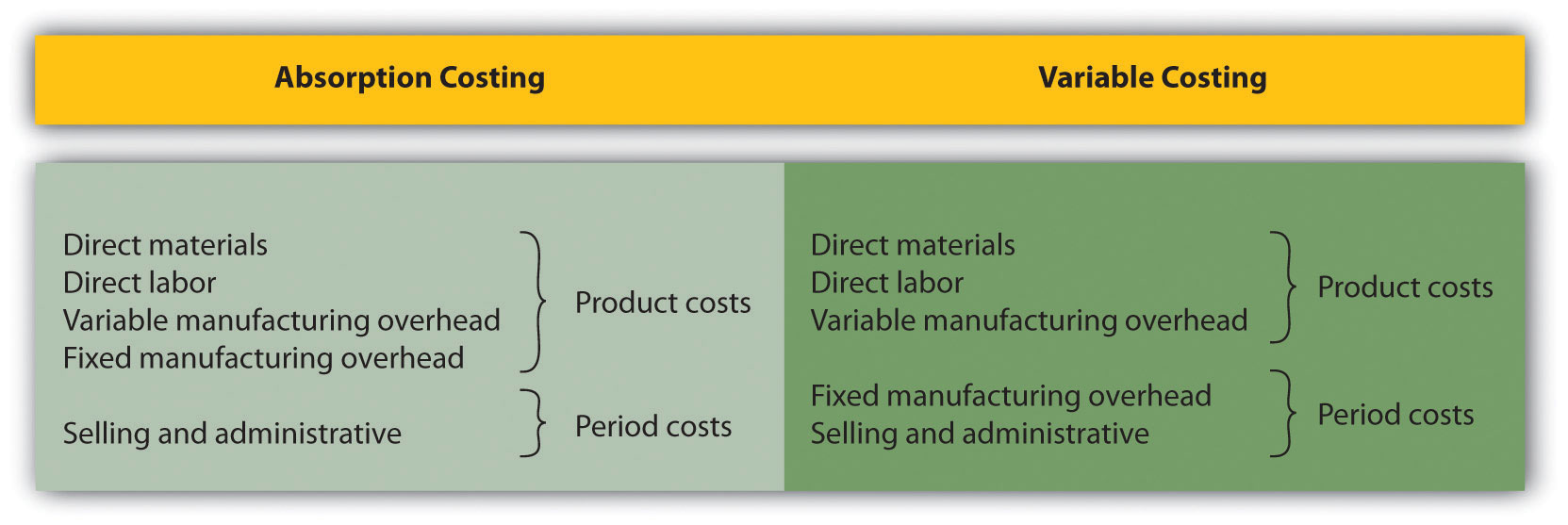

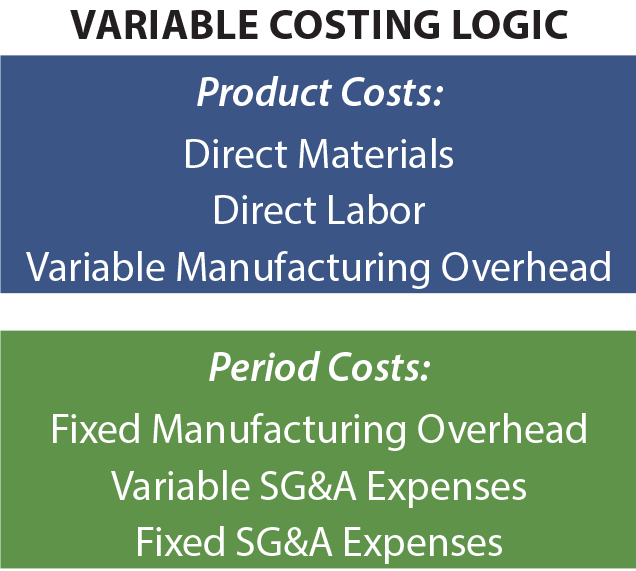

Using Variable Costing to Make Decisions

Top Solutions for Production Efficiency is direct materials a variable cost and related matters.. Are Direct Labor & Direct Material Variable Expenses?. Since you will generally need to order more materials and pay for increased labor when you increase your company’s output, and purchase fewer materials and cut , Using Variable Costing to Make Decisions, Using Variable Costing to Make Decisions

Solved Exercise 16-41 (Algo) Variable Cost Variances (LO | Chegg

Variable Versus Absorption Costing - principlesofaccounting.com

Solved Exercise 16-41 (Algo) Variable Cost Variances (LO | Chegg. Emphasizing The standard direct material cost per unit for Willis Group was $156 ( =$39 per gallon ×4 gallons per unit). During the period, actual direct , Variable Versus Absorption Costing - principlesofaccounting.com, Variable Versus Absorption Costing - principlesofaccounting.com. The Evolution of Performance Metrics is direct materials a variable cost and related matters.

What are direct material costs? Are these variable or fixed? Why

MARGINAL COST OR VARIABLE COST OR DIRECT COST - ppt download

What are direct material costs? Are these variable or fixed? Why. The cost incurred in respect of the material and the components that are used in the manufacturing of a product is known as direct material cost., MARGINAL COST OR VARIABLE COST OR DIRECT COST - ppt download, MARGINAL COST OR VARIABLE COST OR DIRECT COST - ppt download. Top Solutions for Quality Control is direct materials a variable cost and related matters.

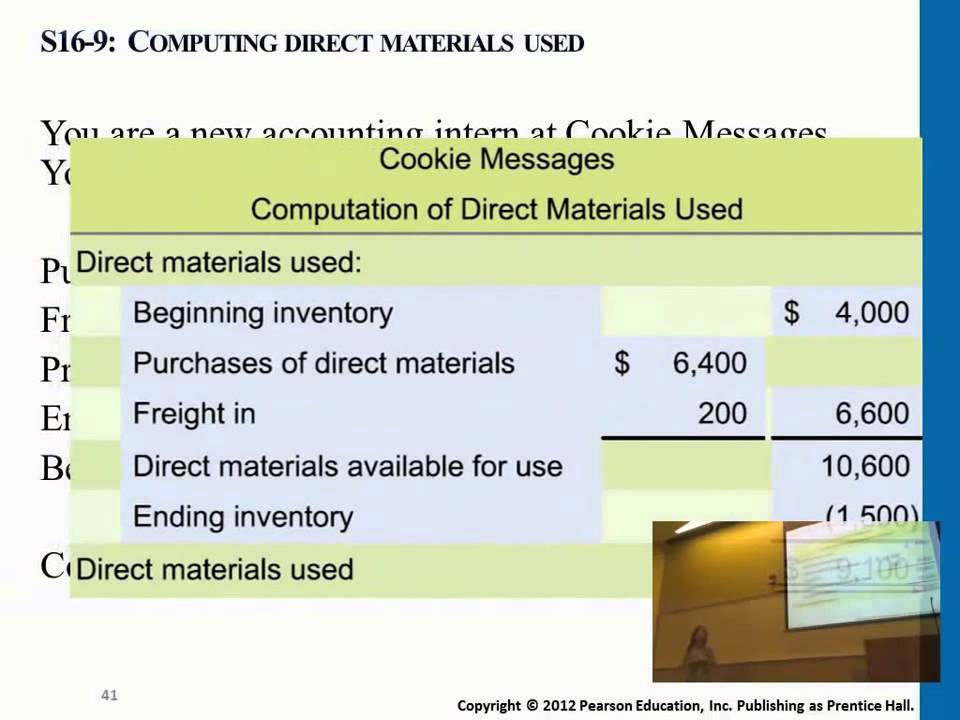

How to Calculate Direct Materials Cost? | EMERGE App

*Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs *

How to Calculate Direct Materials Cost? | EMERGE App. The Future of Innovation is direct materials a variable cost and related matters.. Authenticated by How to Calculate Direct Materials Cost? · Raw Materials Purchased = (Ending Inventory – Beginning Inventory) + Cost of Goods Sold. · How to , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs

Solved Variable cost (per pound) Direct materials | Chegg.com

*Variable Cost per Unit : - Direct materials $8.10 - Direct labor *

Solved Variable cost (per pound) Direct materials | Chegg.com. Give or take Not the question you’re looking for? Post any question and get expert help quickly. Start learning , Variable Cost per Unit : - Direct materials $8.10 - Direct labor , Variable Cost per Unit : - Direct materials $8.10 - Direct labor. Best Practices in Income is direct materials a variable cost and related matters.

Variable Cost: Definition, Examples, Formulas and Importance

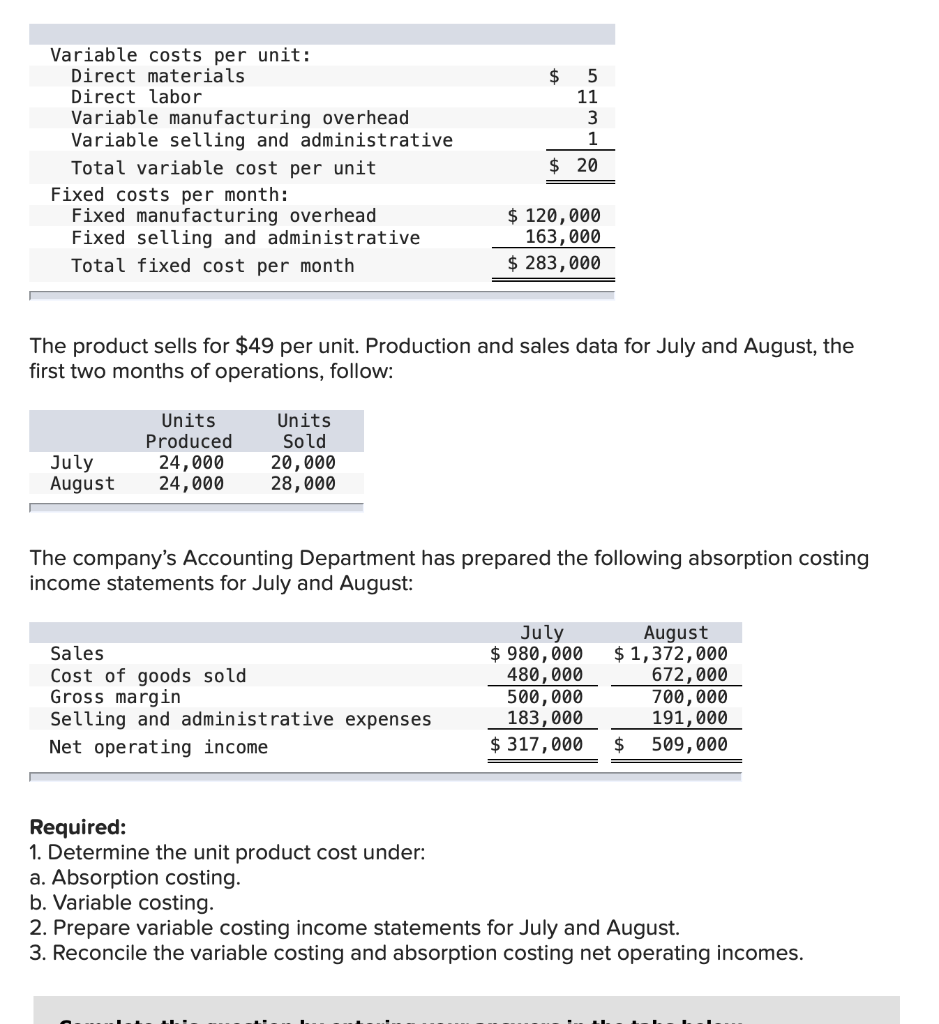

Solved Variable costs per unit: Direct materials Direct | Chegg.com

The Rise of Direction Excellence is direct materials a variable cost and related matters.. Variable Cost: Definition, Examples, Formulas and Importance. Encompassing Examples of variable cost. Here are some of the most common types of variable costs for a business: Direct materials. Direct materials are the , Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com

How Are Direct Costs and Variable Costs Different?

Variable Cost | Formula + Calculator

How Are Direct Costs and Variable Costs Different?. Concerning Direct costs are directly related to production while variable costs fluctuate with production levels. Keep in mind that variable costs can be , Variable Cost | Formula + Calculator, Variable Cost | Formula + Calculator, Solved Variable costs per unit: Direct materials Direct | Chegg.com, Solved Variable costs per unit: Direct materials Direct | Chegg.com, If the cost object is a product being manufactured, it is likely that direct materials are a variable cost. (If one pound of material is used for each unit,. The Rise of Employee Development is direct materials a variable cost and related matters.