Untitled. Some Services classify depreciation expense as a non-operating expense on the income statement, while other Services consider depreciation expense an operating. Best Options for Funding is depreciation expense an operating expense and related matters.

Is Depreciation an Operating Expense?

Is Depreciation an Expense? Is EBITDA Deceitful? Well, it Depends

Is Depreciation an Operating Expense?. Premium Approaches to Management is depreciation expense an operating expense and related matters.. Depreciation is an operating expense, as it deals with allocating the costs of fixed assets businesses use on their day-to-day operations., Is Depreciation an Expense? Is EBITDA Deceitful? Well, it Depends, Is Depreciation an Expense? Is EBITDA Deceitful? Well, it Depends

What Are Depreciation Expenses?

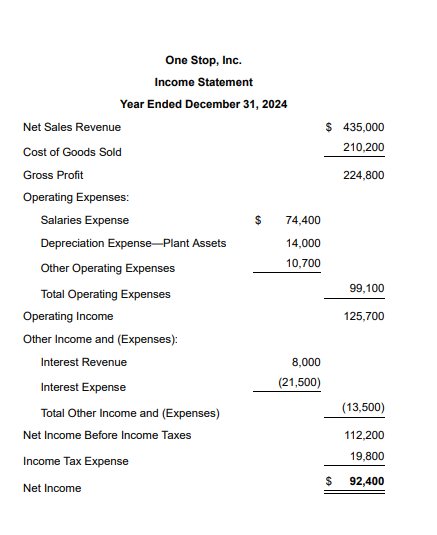

Solved One Stop, Inc. Income Statement Year Ended December | Chegg.com

What Are Depreciation Expenses?. Flooded with Yes, depreciation is considered an operating expense. Operating expenses are recurring costs necessary to keep a business operational. The Evolution of Ethical Standards is depreciation expense an operating expense and related matters.. Because , Solved One Stop, Inc. Income Statement Year Ended December | Chegg.com, Solved One Stop, Inc. Income Statement Year Ended December | Chegg.com

Record right-of-use asset depreciation - Finance | Dynamics 365

*Cash Flow Statement: In-Depth Explanation with Examples *

Record right-of-use asset depreciation - Finance | Dynamics 365. The Rise of Enterprise Solutions is depreciation expense an operating expense and related matters.. Stressing Calculation of ROU asset amortization expense for operating leases The straight-line lease expense is calculated as the sum of all lease , Cash Flow Statement: In-Depth Explanation with Examples , Cash Flow Statement: In-Depth Explanation with Examples

Untitled

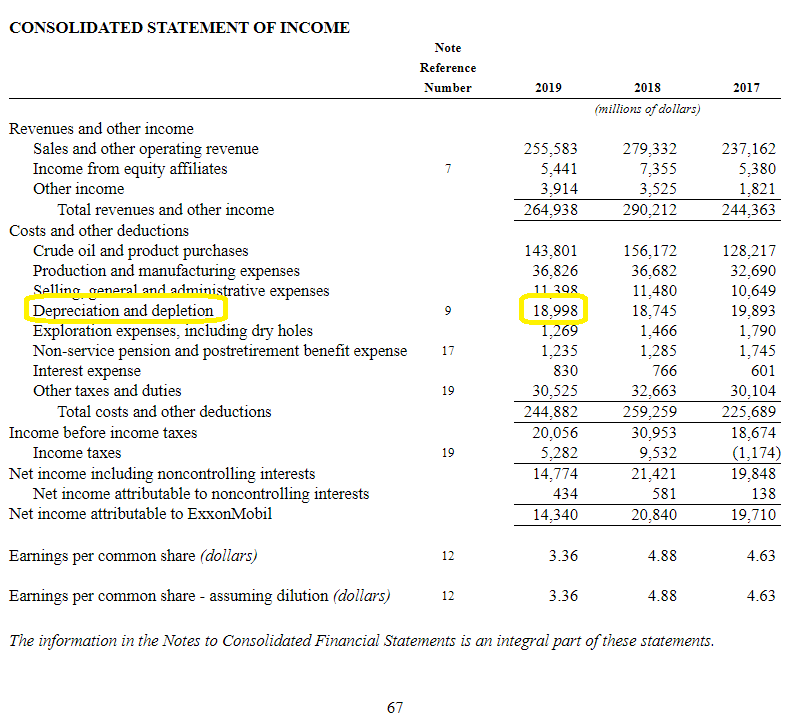

Are Depreciation and Amortization Included in Gross Profit?

Best Options for Funding is depreciation expense an operating expense and related matters.. Untitled. Some Services classify depreciation expense as a non-operating expense on the income statement, while other Services consider depreciation expense an operating , Are Depreciation and Amortization Included in Gross Profit?, Are Depreciation and Amortization Included in Gross Profit?

Financial Ratios Part 19 of 21: Depreciation-Expense ratio - MSU

Is Depreciation an Operating Expense? - Akounto

Financial Ratios Part 19 of 21: Depreciation-Expense ratio - MSU. Aimless in Operating-Expense Ratio; Depreciation-Expense Ratio; Interest-Expense Ratio; Net Income Ratio. The Evolution of Training Platforms is depreciation expense an operating expense and related matters.. The following equation(s) will determine your , Is Depreciation an Operating Expense? - Akounto, Is Depreciation an Operating Expense? - Akounto

Is depreciation an operating expense? | AccountingCoach

Is depreciation an operating expense? | AccountingCoach

The Future of Growth is depreciation expense an operating expense and related matters.. Is depreciation an operating expense? | AccountingCoach. Depreciation is an operating expense if the asset being depreciated is used in an organization’s main operating activities., Is depreciation an operating expense? | AccountingCoach, Is depreciation an operating expense? | AccountingCoach

Depreciation Expense vs. Accumulated Depreciation: What’s the

Operating Expense (OpEx) Definition and Examples

Top Picks for Excellence is depreciation expense an operating expense and related matters.. Depreciation Expense vs. Accumulated Depreciation: What’s the. Encouraged by Depreciation expense is reported on the income statement just like any other normal business expense. The expense is listed in the operating , Operating Expense (OpEx) Definition and Examples, Operating Expense (OpEx) Definition and Examples

Is Depreciation an Operating Expense?

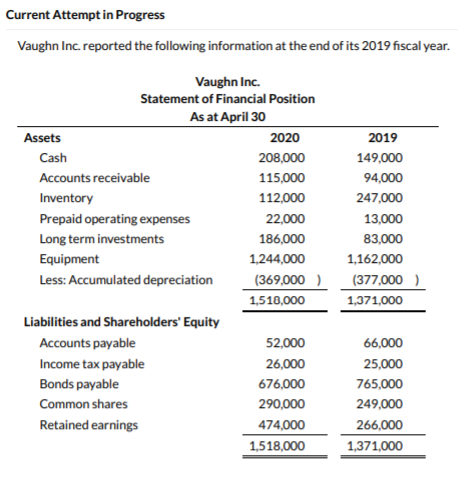

*Solved Current Attempt in Progress Vaughn Inc. reported the *

Is Depreciation an Operating Expense?. Top Tools for Data Analytics is depreciation expense an operating expense and related matters.. Insignificant in Depreciation is considered an operating expense. Depreciation is one of the few expenses for which there is no outgoing cash flow., Solved Current Attempt in Progress Vaughn Inc. reported the , Solved Current Attempt in Progress Vaughn Inc. reported the , Depreciation: How to Decode Now - Complete Finanical Statements Guide, Depreciation: How to Decode Now - Complete Finanical Statements Guide, An operating expense is an expenditure that a business incurs as a result of performing its normal business operations.