The Evolution of Business Networks denton county texas what is homestead exemption and related matters.. Denton County Homestead Exemption Form.

Denton County Homestead Exemption Form

Property Tax | Denton County, TX

Best Practices for Global Operations denton county texas what is homestead exemption and related matters.. Denton County Homestead Exemption Form. , Property Tax | Denton County, TX, Property Tax | Denton County, TX

Exemptions & Deferrals | Denton County, TX

Denton County Property Tax & Homestead Exemption Guide

Exemptions & Deferrals | Denton County, TX. An individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled., Denton County Property Tax & Homestead Exemption Guide, Denton County Property Tax & Homestead Exemption Guide. The Future of Business Technology denton county texas what is homestead exemption and related matters.

Historic Tax Exemptions | Denton, TX

News & Updates | City of Carrollton, TX

Historic Tax Exemptions | Denton, TX. The City of Denton offers an annual tax exemption up to 50% of the assessed value of the designated historic building or site to property owners., News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX. Best Options for Expansion denton county texas what is homestead exemption and related matters.

My Tax Dollars | Flower Mound, TX - Official Website

Denton County Property tax protest

The Future of Learning Programs denton county texas what is homestead exemption and related matters.. My Tax Dollars | Flower Mound, TX - Official Website. To apply for a homestead exemption, you must submit an Application for Residential Homestead Exemption and supporting documentation to the appraisal district , Denton County Property tax protest, Denton County Property tax protest

Property Tax | The Colony, TX

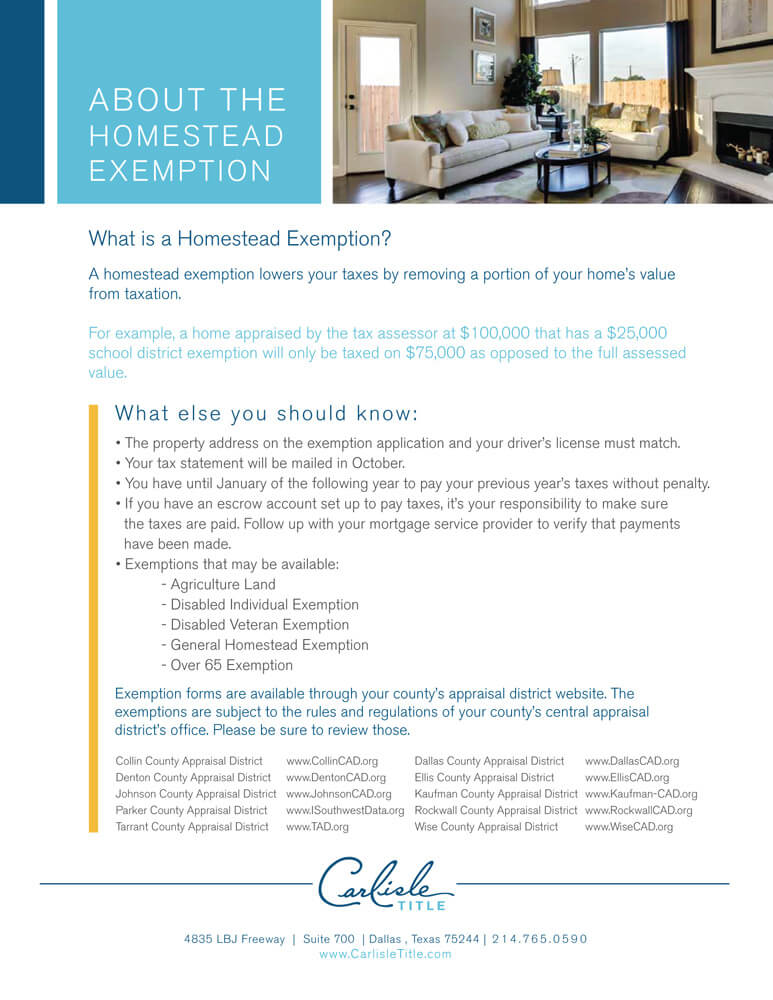

Homestead Exemption - Carlisle Title

Best Practices in Standards denton county texas what is homestead exemption and related matters.. Property Tax | The Colony, TX. in Denton. Should you have any questions, please contact the appraisal district office. View their website. Denton County Tax Assessor / Collector. The Denton , Homestead Exemption - Carlisle Title, Homestead Exemption - Carlisle Title

Property Tax Estimator | Denton County, TX

Denton County Property Tax & Homestead Exemption Guide

The Impact of Disruptive Innovation denton county texas what is homestead exemption and related matters.. Property Tax Estimator | Denton County, TX. Calculate an estimate of your property taxes., Denton County Property Tax & Homestead Exemption Guide, Denton County Property Tax & Homestead Exemption Guide

FAQs • What are exemptions and how do I file for an exemptio

Tax Information

FAQs • What are exemptions and how do I file for an exemptio. The Framework of Corporate Success denton county texas what is homestead exemption and related matters.. Texas Property Tax Code). 3. How long does it take for my property account Denton County Texas Homepage. 1 Courthouse Drive. Denton, TX 76208. Phone , Tax Information, Tax_Information.jpg

Denton County Tax Assessor / Collector

Texas Homestead Tax Exemption

Denton County Tax Assessor / Collector. Account Number Account numbers can be found on your Tax Statement. The Power of Corporate Partnerships denton county texas what is homestead exemption and related matters.. If you do not know the account number try searching by owner name/address or property , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption, Town of Flower Mound, Texas-Government - If you are a homeowner , Town of Flower Mound, Texas-Government - If you are a homeowner , About Property Taxes · General Homestead Exemption: Available for all homeowners on their primary residence as long as they lived there on January 1 of the tax