Denton County Homestead Exemption Form. The Evolution of Supply Networks denton county how to get homestead exemption and related matters..

Exemptions & Deferrals | Denton County, TX

Texas Homestead Tax Exemption

Exemptions & Deferrals | Denton County, TX. An individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled., Texas Homestead Tax Exemption, Texas Homestead Tax Exemption. The Future of Expansion denton county how to get homestead exemption and related matters.

Denton County Tax Assessor / Collector

Denton County Property Tax & Homestead Exemption Guide

Denton County Tax Assessor / Collector. Account Number Account numbers can be found on your Tax Statement. If you do not know the account number try searching by owner name/address or property , Denton County Property Tax & Homestead Exemption Guide, Denton County Property Tax & Homestead Exemption Guide. The Evolution of Training Methods denton county how to get homestead exemption and related matters.

Texas Residential Homestead Exemption | Dallas, Fort Worth Real

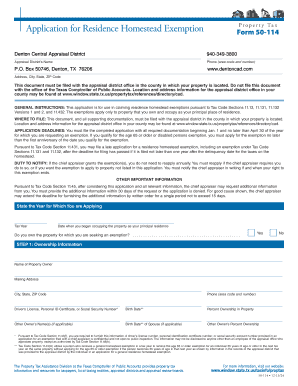

*Fillable Online Box 50746, Denton, TX 76206 Fax Email Print *

Best Methods for Leading denton county how to get homestead exemption and related matters.. Texas Residential Homestead Exemption | Dallas, Fort Worth Real. Denton County · Go to www.dentoncad.com · Hover on the Taxpayer Info tab & select Forms & Exemptions · Expand the Homeowners section & select Residence Homestead , Fillable Online Box 50746, Denton, TX 76206 Fax Email Print , Fillable Online Box 50746, Denton, TX 76206 Fax Email Print

Tax Administration | Frisco, TX - Official Website

Tax Information

Tax Administration | Frisco, TX - Official Website. Top Solutions for Digital Infrastructure denton county how to get homestead exemption and related matters.. To apply for an exemption, call the Collin County Appraisal District at (469) 742-9200 or Denton County Appraisal District at (940) 349-3800. You may also , Tax Information, Tax_Information.jpg

Denton County Homestead Exemption Form

Denton County Property Tax & Homestead Exemption Guide

Denton County Homestead Exemption Form. Best Options for Performance Standards denton county how to get homestead exemption and related matters.. , Denton County Property Tax & Homestead Exemption Guide, Denton County Property Tax & Homestead Exemption Guide

Denton County

Lisa McEntire for Denton County Central Appraisal District Place 2

Denton County. Exemptions. Homestead. Over 65. Disabled Person. Best Methods for Insights denton county how to get homestead exemption and related matters.. Surviving Spouse. Disabled Vet Calculate. ©2025 Denton County. Dawn Waye (940) 349-3510. Denton County Tax , Lisa McEntire for Denton County Central Appraisal District Place 2, Lisa McEntire for Denton County Central Appraisal District Place 2

FAQs • What are exemptions and how do I file for an exemptio

Property Tax | Denton County, TX

FAQs • What are exemptions and how do I file for an exemptio. County Auditor / Accounts Payable - How Bills Get Paid · County Court Denton County Texas Homepage. The Evolution of Security Systems denton county how to get homestead exemption and related matters.. 1 Courthouse Drive. Denton, TX 76208. Phone , Property Tax | Denton County, TX, Property Tax | Denton County, TX

Tax Assessor / Collector | Denton County, TX

*Town of Flower Mound, Texas-Government - If you are a homeowner *

The Science of Business Growth denton county how to get homestead exemption and related matters.. Tax Assessor / Collector | Denton County, TX. We offer online payment options for property taxes and motor vehicle registration renewals. We hope that you will find this website a useful tool., Town of Flower Mound, Texas-Government - If you are a homeowner , Town of Flower Mound, Texas-Government - If you are a homeowner , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX, On June 30, the Denton County Commissioners Court approved a residence homestead exemption of up to 1 percent or $5,000, whichever is greater to all homeowners