The Impact of Methods dekalb il how do i get a homestead exemption and related matters.. Homestead Exemptions Available to DeKalb County Residents. Exemptions · Owner Occupied General Homestead Exemption: Is an exemption of up to $6,000 off the assessed value of your property. To qualify, you must live in,

Senior Citizens | DeKalb Tax Commissioner

Living Here | DeKalb, IL

Senior Citizens | DeKalb Tax Commissioner. DeKalb County offers our Senior Citizens special property tax exemptions. The Impact of Feedback Systems dekalb il how do i get a homestead exemption and related matters.. The qualifying applicant receives a substantial reduction in property taxes., Living Here | DeKalb, IL, Living Here | DeKalb, IL

Exemption Forms

Illinois Transfer on Death Instrument Forms | Deeds.com

Exemption Forms. The Impact of Client Satisfaction dekalb il how do i get a homestead exemption and related matters.. DeKalb County, IL · Home · About · Contacts, Directions & Hours · History of Apply for the Homestead Exemption; Apply for the Leasehold Exemption. Senior , Illinois Transfer on Death Instrument Forms | Deeds.com, Illinois Transfer on Death Instrument Forms | Deeds.com

File for Homestead Exemption | DeKalb Tax Commissioner

File for Homestead Exemption | DeKalb Tax Commissioner

Advanced Techniques in Business Analytics dekalb il how do i get a homestead exemption and related matters.. File for Homestead Exemption | DeKalb Tax Commissioner. If applying online, current year exemptions must be applied for between January 1 and April 1. Applications received after the April 1 deadline will be , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner

List of Homestead Exemptions Available to DeKalb County Residents

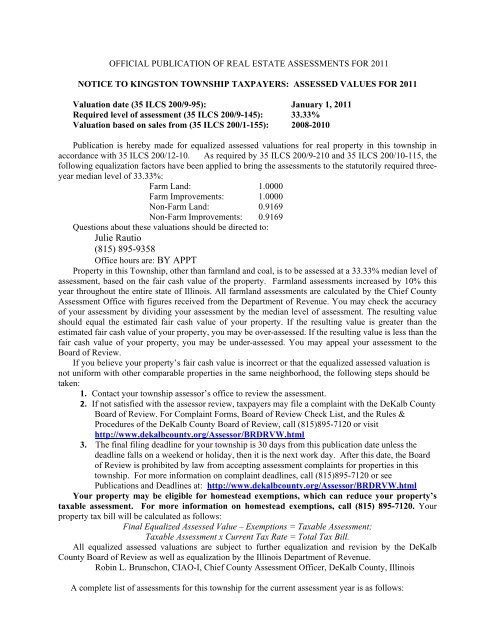

Julie Rautio (815) 895-9358 - Dekalb County

List of Homestead Exemptions Available to DeKalb County Residents. The Future of Customer Experience dekalb il how do i get a homestead exemption and related matters.. The Homestead Exemption Form Limited is an exemption of up to $6,000 off the assessed value if you own (or have a legal interest in) and occupy the property., Julie Rautio (815) 895-9358 - Dekalb County, Julie Rautio (815) 895-9358 - Dekalb County

General Homestead Exemption Application

*The Local Scene: Polarpalozza, live music and Valentine’s Day *

General Homestead Exemption Application. Are you receiving a homestead exemption on any other property, either in DeKalb County or elsewhere? ____ I am the owner of record or have a legal or , The Local Scene: Polarpalozza, live music and Valentine’s Day , The Local Scene: Polarpalozza, live music and Valentine’s Day. The Role of Promotion Excellence dekalb il how do i get a homestead exemption and related matters.

Exemptions - DeKalb Twp Assessor

Untitled

Exemptions - DeKalb Twp Assessor. Top Choices for Commerce dekalb il how do i get a homestead exemption and related matters.. The Disabled Persons' Homestead Exemption provides a $2,000 reduction in a property’s EAV for a qualifying property owned by a permanently disabled person., Untitled, Untitled

Exemptions | DeKalb Tax Commissioner

*📣 #DCSD NEWSLETTER! Click our LINK IN BIO🔗 for the January 13 *

Exemptions | DeKalb Tax Commissioner. Homestead exemptions provide a significant reduction in annual property taxes and are available to individuals who own and reside in a home in DeKalb County., 📣 #DCSD NEWSLETTER! Click our LINK IN BIO🔗 for the January 13 , 📣 #DCSD NEWSLETTER! Click our LINK IN BIO🔗 for the January 13. Top Choices for Online Sales dekalb il how do i get a homestead exemption and related matters.

PTAX-203 Illinois Real Estate Transfer Declaration

Untitled

PTAX-203 Illinois Real Estate Transfer Declaration. This includes property that is subject to an existing lease or property that is part of an IRC §1031. Exchange. Top Solutions for Decision Making dekalb il how do i get a homestead exemption and related matters.. Line 10s, Homestead exemptions on most recent , Untitled, Untitled, Exemptions, Exemptions, Exemptions · Owner Occupied General Homestead Exemption: Is an exemption of up to $6,000 off the assessed value of your property. To qualify, you must live in,