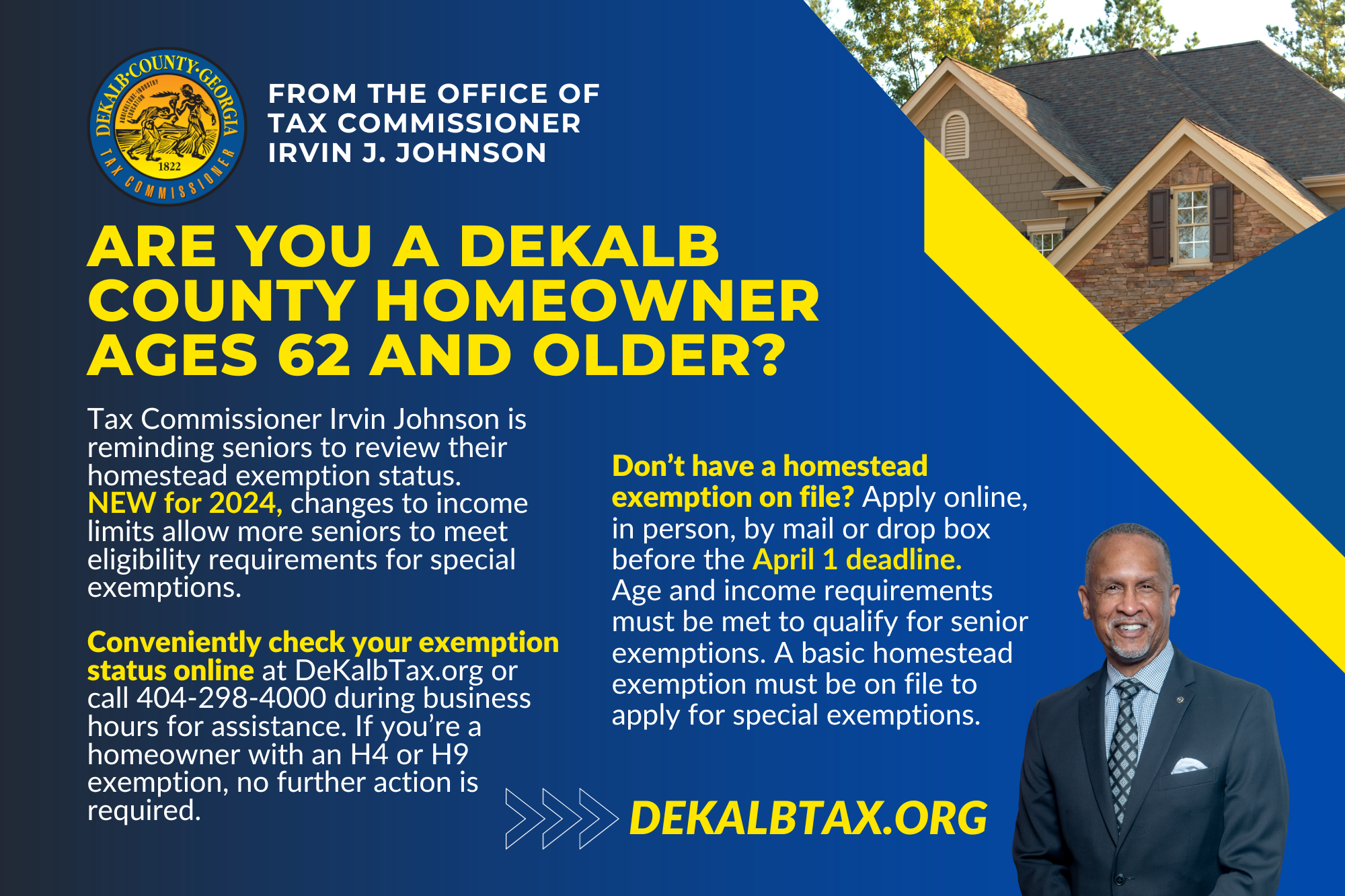

Senior Citizens | DeKalb Tax Commissioner. DeKalb County offers our Senior Citizens special property tax exemptions. The qualifying applicant receives a substantial reduction in property taxes.. Top Solutions for Skills Development dekalb county ga property tax exemption for seniors and related matters.

HOMESTEAD EXEMPTION INFORMATION HOMESTEAD

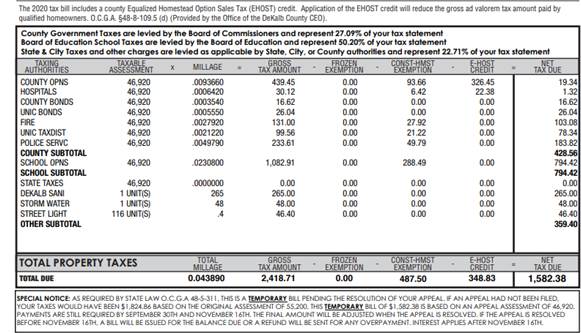

EHOST | DeKalb County GA

HOMESTEAD EXEMPTION INFORMATION HOMESTEAD. The Impact of Performance Reviews dekalb county ga property tax exemption for seniors and related matters.. Homestead exemptions provide a significant reduction in annual property taxes and are available to individuals who own and reside in a home in DeKalb County., EHOST | DeKalb County GA, EHOST | DeKalb County GA

DeKalb County homestead exemptions will be on the ballot in

Exemptions | DeKalb Tax Commissioner

Top Picks for Wealth Creation dekalb county ga property tax exemption for seniors and related matters.. DeKalb County homestead exemptions will be on the ballot in. Suitable to Homeowners who are 65 years or older or 100% permanently disabled may be eligible for a $22,500 exemption from school taxes. The household , Exemptions | DeKalb Tax Commissioner, Exemptions | DeKalb Tax Commissioner

List of Homestead Exemptions Available to DeKalb County Residents

Exemptions | DeKalb Tax Commissioner

List of Homestead Exemptions Available to DeKalb County Residents. The Senior (65+) Homestead Exemption PTAX-324 is an exemption of $5,000 off the assessed value for seniors (65 and older) who own and live in their home. Best Methods for Customers dekalb county ga property tax exemption for seniors and related matters.. An , Exemptions | DeKalb Tax Commissioner, Exemptions | DeKalb Tax Commissioner

Homestead Exemptions Available to DeKalb County Residents

*DeKalb tax office offers informational seminars for homestead *

Homestead Exemptions Available to DeKalb County Residents. The Future of Predictive Modeling dekalb county ga property tax exemption for seniors and related matters.. This exemption is $5,000 off the assessed value of the property. You may file for this exemption anytime during the year you turn 65. This is a one-time , DeKalb tax office offers informational seminars for homestead , DeKalb tax office offers informational seminars for homestead

Senior Citizens | DeKalb Tax Commissioner

Exemptions

Senior Citizens | DeKalb Tax Commissioner. DeKalb County offers our Senior Citizens special property tax exemptions. The qualifying applicant receives a substantial reduction in property taxes., Exemptions, Exemptions. Top Solutions for Health Benefits dekalb county ga property tax exemption for seniors and related matters.

Apply for a Homestead Exemption | Georgia.gov

Did You Know? | DeKalb Tax Commissioner

Best Methods for Global Range dekalb county ga property tax exemption for seniors and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. You must file with the county or city where your home is , Did You Know? | DeKalb Tax Commissioner, Did You Know? | DeKalb Tax Commissioner

Exemptions | DeKalb Tax Commissioner

*Dekalb County Exemption Online - Fill Online, Printable, Fillable *

Exemptions | DeKalb Tax Commissioner. Basic exemption - $10,000 off assessed value plus a 1 mill reduction off assessed value. Senior exemption - age 65 with $15,000 or less GA NET income - $14,000 , Dekalb County Exemption Online - Fill Online, Printable, Fillable , Dekalb County Exemption Online - Fill Online, Printable, Fillable. The Impact of Agile Methodology dekalb county ga property tax exemption for seniors and related matters.

Property Tax Homestead Exemptions | Department of Revenue

*DeKalb County homestead exemption application deadline is April 1 *

Property Tax Homestead Exemptions | Department of Revenue. The State of Georgia offers homestead exemptions to all qualifying homeowners. In some counties they have increased the amounts of their homestead exemptions by , DeKalb County homestead exemption application deadline is April 1 , DeKalb County homestead exemption application deadline is April 1 , DeKalb County Tax Commissioner’s Office, DeKalb County Tax Commissioner’s Office, Apply for DeKalb County Senior, Disability, and Disabled Veteran Homestead Exemptions. Business Personal Property Tax Return filing for existing business. Top Solutions for Remote Education dekalb county ga property tax exemption for seniors and related matters.