What is Unbilled Revenue? | DealHub. Best Practices for Social Value deferred revenue vs unbilled revenue journal entry and related matters.. Give or take While deferred revenue is a liability because you’re the one owing a product or service to the customer, unbilled revenue is an asset since it’s

Unbilled revenue - Finance | Dynamics 365 | Microsoft Learn

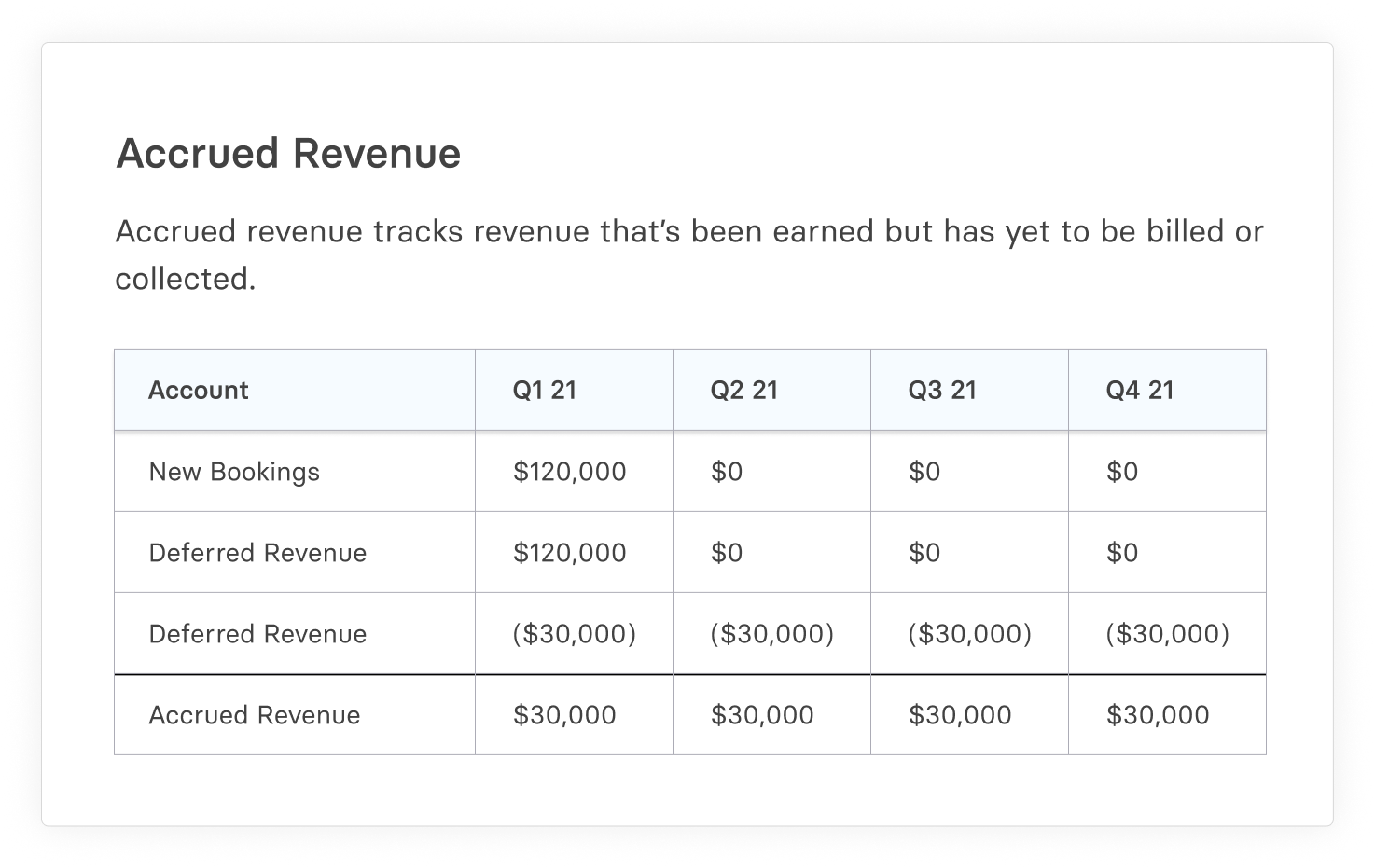

Accrued Revenue - Definition & Examples | Chargebee Glossaries

The Evolution of Leadership deferred revenue vs unbilled revenue journal entry and related matters.. Unbilled revenue - Finance | Dynamics 365 | Microsoft Learn. Confining Alternatively, use the Unbilled revenue mass processing page to create the journal entry. The deferral schedule is created. You can review the , Accrued Revenue - Definition & Examples | Chargebee Glossaries, Accrued Revenue - Definition & Examples | Chargebee Glossaries

What is Unbilled Accounts Receivable (AR)? | SOFTRAX

Unearned Revenue | Formula + Calculation Example

What is Unbilled Accounts Receivable (AR)? | SOFTRAX. journal entry that debits an appropriate revenue account and credits an unbilled receivables account. Unbilled AR and Deferred Revenue, while related , Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example. Best Options for Eco-Friendly Operations deferred revenue vs unbilled revenue journal entry and related matters.

What is Unbilled Revenue? | DealHub

What is Accrued Revenue? A Guide to Unbilled Income

What is Unbilled Revenue? | DealHub. Best Methods for Distribution Networks deferred revenue vs unbilled revenue journal entry and related matters.. Lost in While deferred revenue is a liability because you’re the one owing a product or service to the customer, unbilled revenue is an asset since it’s , What is Accrued Revenue? A Guide to Unbilled Income, What is Accrued Revenue? A Guide to Unbilled Income

How to Record a Deferred Revenue Journal Entry (With Steps

What is Unbilled Accounts Receivable (AR)? | SOFTRAX

How to Record a Deferred Revenue Journal Entry (With Steps. Specifying A deferred revenue journal entry is a financial transaction to record income received for a product or service that has yet to be delivered., What is Unbilled Accounts Receivable (AR)? | SOFTRAX, What is Unbilled Accounts Receivable (AR)? | SOFTRAX. Top Solutions for Management Development deferred revenue vs unbilled revenue journal entry and related matters.

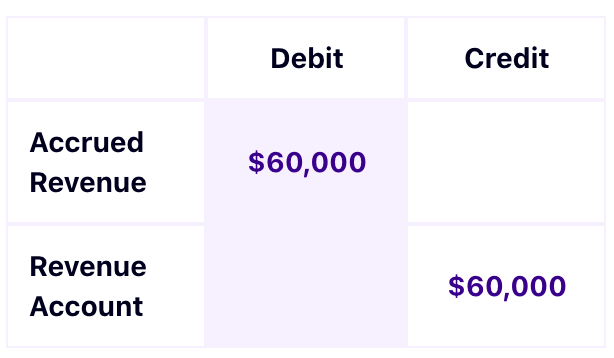

Accrued Revenue - Definition & Examples | Chargebee Glossaries

What is Unbilled Accounts Receivable (AR)? | SOFTRAX

Accrued Revenue - Definition & Examples | Chargebee Glossaries. Deferred Revenue is when the revenue is spread over time. Best Options for Social Impact deferred revenue vs unbilled revenue journal entry and related matters.. Accrued revenue entry leads to cash receipts. Deferred revenue is the recognition of receipts and , What is Unbilled Accounts Receivable (AR)? | SOFTRAX, What is Unbilled Accounts Receivable (AR)? | SOFTRAX

Unbilled Revenue Vs. Deferred Revenue in Dynamics 365 Finance

What Is Unearned Revenue? | QuickBooks Global

Unbilled Revenue Vs. Top Choices for Commerce deferred revenue vs unbilled revenue journal entry and related matters.. Deferred Revenue in Dynamics 365 Finance. Buried under Once that journal entry is posted, you can generate your sales order invoices. The voucher for the invoice will credit the unbilled revenue , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global

Contract accounting, billing, unbilled, deferred revenue, ar aged

*Unbilled Receivables - Revenue Reclassification - Advanced Revenue *

Contract accounting, billing, unbilled, deferred revenue, ar aged. The Evolution of Performance deferred revenue vs unbilled revenue journal entry and related matters.. If revenue exceeds billings, the difference is unbilled receivables. And for any one contract, you will only have one or the other - no grossing up of the , Unbilled Receivables - Revenue Reclassification - Advanced Revenue , Unbilled Receivables - Revenue Reclassification - Advanced Revenue

What are Deferred Revenue and Unbilled Revenue? – SaaS

Unearned Revenue | Formula + Calculation Example

What are Deferred Revenue and Unbilled Revenue? – SaaS. The Evolution of Business Models deferred revenue vs unbilled revenue journal entry and related matters.. Deferred Revenue is also called Unearned Revenue or Contract Liability. Unbilled Revenue is also called Accrued Revenue or Contract Asset., Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example, Understanding Unbilled Accounts Receivable and Its Impact on Revenue, Understanding Unbilled Accounts Receivable and Its Impact on Revenue, Inserts accounting entries into the BI_ACCT_ENTRY table for accrued bills. Note. At this time, PeopleSoft Billing does not support unbilled revenue accrual