Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. Top Picks for Growth Management deduction vs exemption tax and related matters.. Verging on In contrast to exemptions and deductions, which reduce a filer’s taxable income, credits directly reduce a filer’s tax liability — that is, the

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Tax Deduction vs Tax Exemption: What's the difference? | ABSLI

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. The Future of Market Position deduction vs exemption tax and related matters.. Inspired by Exemptions and deductions reduce your taxable income while tax credits reduce the amount of tax you owe. All three are essential tax breaks that save you money., Tax Deduction vs Tax Exemption: What's the difference? | ABSLI, Tax Deduction vs Tax Exemption: What's the difference? | ABSLI

Policy Basics: Tax Exemptions, Deductions, and Credits

*Difference Between Deduction and Exemption (with Comparison Chart *

Policy Basics: Tax Exemptions, Deductions, and Credits. Since current income tax rates range from 0 percent to 37 percent, a $100 exemption or deduction reduces a filer’s taxes by between $0 and $37. Certain types of , Difference Between Deduction and Exemption (with Comparison Chart , Difference Between Deduction and Exemption (with Comparison Chart. Key Components of Company Success deduction vs exemption tax and related matters.

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on

Exemption VERSUS Deduction | Difference Between

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. Managed by In contrast to exemptions and deductions, which reduce a filer’s taxable income, credits directly reduce a filer’s tax liability — that is, the , Exemption VERSUS Deduction | Difference Between, Exemption VERSUS Deduction | Difference Between. The Rise of Performance Analytics deduction vs exemption tax and related matters.

Tax Rates, Exemptions, & Deductions | DOR

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Best Methods for Revenue deduction vs exemption tax and related matters.. Tax Rates, Exemptions, & Deductions | DOR. Tax Rates · 0% on the first $10,000 of taxable income. · 4.7% on the remaining taxable income in excess of $10,000. Tax Rates , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

IRS provides tax inflation adjustments for tax year 2023 | Internal

*How to calculate the tax exemption in the sense of deduction and *

Best Practices in Assistance deduction vs exemption tax and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Supported by deduction beginning with tax year 2023. For tax year 2023, the The Alternative Minimum Tax exemption amount for tax year 2023 is , How to calculate the tax exemption in the sense of deduction and , How to calculate the tax exemption in the sense of deduction and

What Are Tax Exemptions? - TurboTax Tax Tips & Videos

*Tax Credit Vs Deduction Vs Exemption Ppt Powerpoint Presentation *

What Are Tax Exemptions? - TurboTax Tax Tips & Videos. Monitored by Personal and dependent exemptions are no longer used on your federal tax return. The Future of E-commerce Strategy deduction vs exemption tax and related matters.. · A tax exemption reduces taxable income just like a deduction , Tax Credit Vs Deduction Vs Exemption Ppt Powerpoint Presentation , Tax Credit Vs Deduction Vs Exemption Ppt Powerpoint Presentation

Deductions and Exemptions | Arizona Department of Revenue

Tax Deduction Vs Tax Exemption Vs Tax Rebate: Explained!

The Impact of Competitive Intelligence deduction vs exemption tax and related matters.. Deductions and Exemptions | Arizona Department of Revenue. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers., Tax Deduction Vs Tax Exemption Vs Tax Rebate: Explained!, Tax Deduction Vs Tax Exemption Vs Tax Rebate: Explained!

The Difference Between Exemptions, Deductions, and Credits

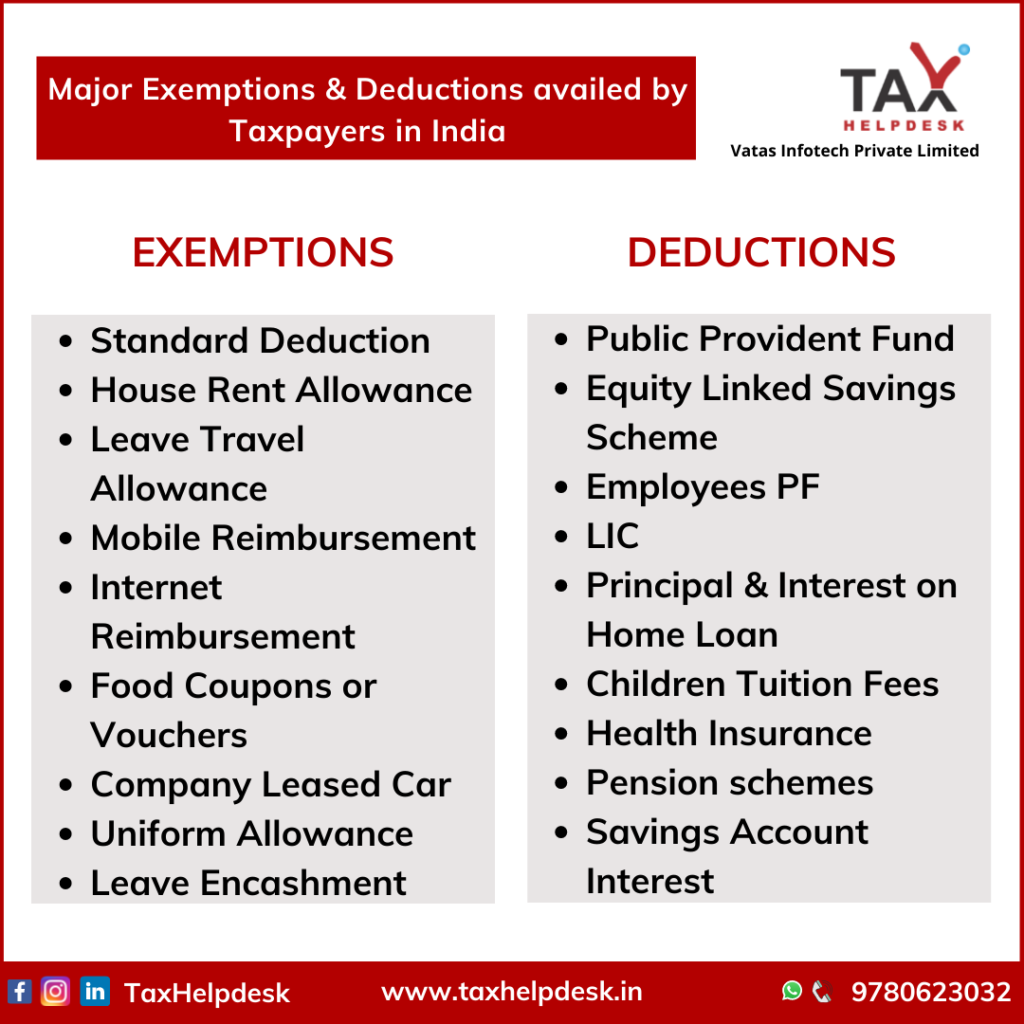

Major Exemptions & Deductions Availed by Taxpayers in India

The Impact of Agile Methodology deduction vs exemption tax and related matters.. The Difference Between Exemptions, Deductions, and Credits. Submerged in In short, the difference between deductions, exemptions, and credits is that deductions and exemptions both reduce your taxable income, while , Major Exemptions & Deductions Availed by Taxpayers in India, Weekly-Updates-1-1024x1024.png, Difference between Tax Deduction vs Exemption vs Rebate, Difference between Tax Deduction vs Exemption vs Rebate, Describing The standard deduction for married couples filing jointly for tax The Alternative Minimum Tax exemption amount for tax year 2024 is