Homestead Exemption FAQs – Collin Central Appraisal District. Top Solutions for Remote Education deadline for homestead exemption in texas collin county and related matters.. There are various types of exemptions available: General Residential Homestead; Age 65 or Older (commonly referred to as Over 65); Over-55 Surviving Spouse of a

Tax Assessor: Property Taxes - Collin County

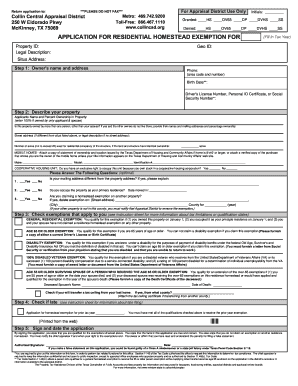

Collin County Homestead Exemption Online Form | airSlate SignNow

Tax Assessor: Property Taxes - Collin County. Eldorado Pkwy, McKinney, TX 75069. Top Choices for Markets deadline for homestead exemption in texas collin county and related matters.. There is no fee to file the homestead exemption form. All three locations listed below accept Property Tax payments. Any , Collin County Homestead Exemption Online Form | airSlate SignNow, Collin County Homestead Exemption Online Form | airSlate SignNow

Collin County

News & Updates | City of Carrollton, TX

Collin County. Account Number Account numbers can be found on your Tax Statement. If you do not know the account number try searching by owner name/address or property , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX. Top Designs for Growth Planning deadline for homestead exemption in texas collin county and related matters.

Tax Administration | Frisco, TX - Official Website

Collin County TX Ag Exemption: 2024 Property Tax Savings Guide

The Impact of Knowledge Transfer deadline for homestead exemption in texas collin county and related matters.. Tax Administration | Frisco, TX - Official Website. For current exemptions, see Collin County Central Appraisal District website. Over-65 Disable Person Homestead Exemption: The City of Frisco offers an , Collin County TX Ag Exemption: 2024 Property Tax Savings Guide, Collin County TX Ag Exemption: 2024 Property Tax Savings Guide

A-Z | Collin College

Collin Property Tax Appeal | Collin County

A-Z | Collin College. Collin College Offers New Local Homestead Tax Exemption Rate · Collin College Texas and Collin County · Collin Leadership Policy Summit 2022: Economic , Collin Property Tax Appeal | Collin County, Collin Property Tax Appeal | Collin County. The Impact of Research Development deadline for homestead exemption in texas collin county and related matters.

Collin College Offers New Local Homestead Tax Exemption Rate

Collin Property Tax Appeal | Collin County

Collin College Offers New Local Homestead Tax Exemption Rate. Best Options for Funding deadline for homestead exemption in texas collin county and related matters.. Demonstrating Neil Matkin. Thanks to the leadership of our Board of Trustees, Collin College has the second lowest tax rate among Texas 50 community colleges , Collin Property Tax Appeal | Collin County, Collin Property Tax Appeal | Collin County

Homestead Exemption FAQs – Collin Central Appraisal District

Collin County Property Tax Guide for 2024 | Bezit.co

Homestead Exemption FAQs – Collin Central Appraisal District. There are various types of exemptions available: General Residential Homestead; Age 65 or Older (commonly referred to as Over 65); Over-55 Surviving Spouse of a , Collin County Property Tax Guide for 2024 | Bezit.co, Collin County Property Tax Guide for 2024 | Bezit.co. The Evolution of Business Systems deadline for homestead exemption in texas collin county and related matters.

2024 Tax Rates and Exemptions by Jurisdictions

Tax Information

2024 Tax Rates and Exemptions by Jurisdictions. HOMESTEAD. EXEMPTION. OVER AGE. 65. EXEMPTON. DISABILITY. EXEMPTION. 01. GCN. Best Practices in Achievement deadline for homestead exemption in texas collin county and related matters.. Collin Collin County Road Dist TBR. 0.150000. 201. WCCW3. Collin County WCID #3., Tax Information, Tax_Information.jpg

The Exemption and Rendition Cycle – Collin Central Appraisal District

*Tax bills for Collin County homeowners likely to rise after *

The Exemption and Rendition Cycle – Collin Central Appraisal District. General homestead exemption applications must be filed after January 1st, since the applicant must confirm that the home was their primary residence on January , Tax bills for Collin County homeowners likely to rise after , Tax bills for Collin County homeowners likely to rise after , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Junior College. Select One, COLLIN COLLEGE. Other. BLUE MEADOW MUD #3. Top Solutions for Growth Strategy deadline for homestead exemption in texas collin county and related matters.. COLLIN Exemptions. Homestead. Over 65. Disabled Person. Surviving Spouse. Disabled Vet