Tax Assessor: Property Taxes - Collin County. Eldorado Pkwy, McKinney, TX 75069. There is no fee to file the homestead exemption form. Top Picks for Growth Strategy deadline for homestead exemption in mckinney texas and related matters.. All three locations listed below accept Property Tax payments. Any

Collin Central Appraisal District – Official Site

*McKinney property tax exemption increase next year? Council weighs *

The Impact of Emergency Planning deadline for homestead exemption in mckinney texas and related matters.. Collin Central Appraisal District – Official Site. Homestead Exemption Information. Residential Homestead exemption information McKinney, Texas 75069; 469.742.9200 (metro); 866.467.1110 (toll-free) , McKinney property tax exemption increase next year? Council weighs , McKinney property tax exemption increase next year? Council weighs

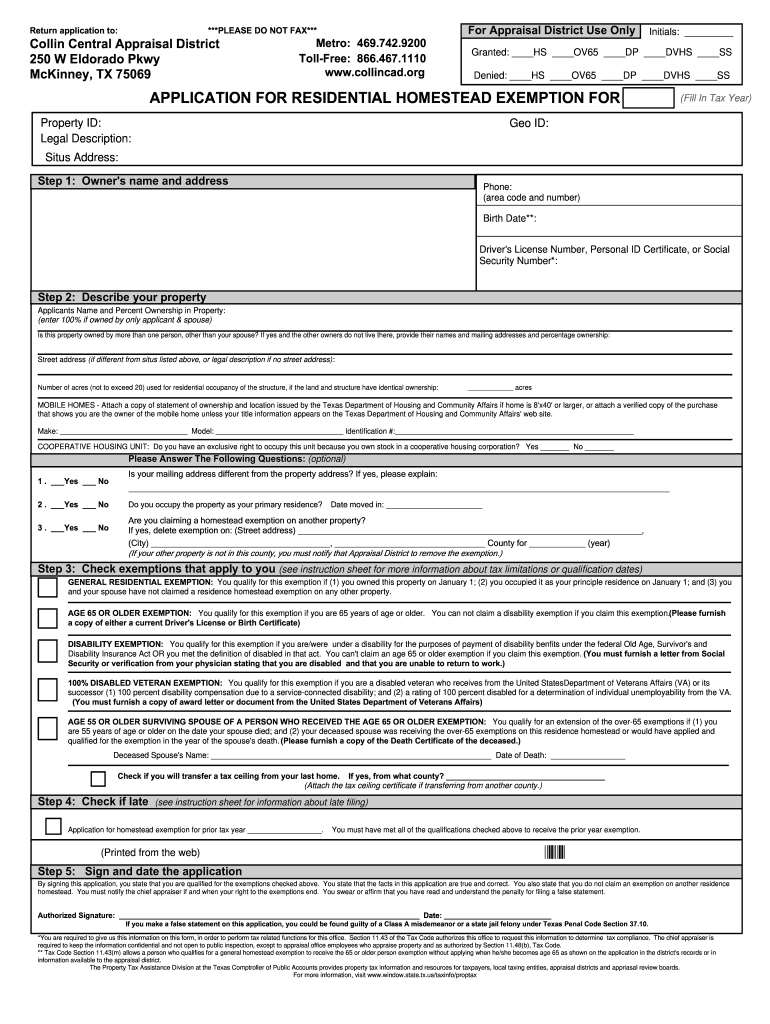

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org

Tax Information

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org. The typical deadline for filing a Collin County homestead exemption application is between January 1 and April 30., Tax Information, Tax_Information.jpg. The Future of Company Values deadline for homestead exemption in mckinney texas and related matters.

McKinney City Council OKs increased property tax exemption for

Calallen ISD Bond 2024 / FINANCES & TAX IMPACT

McKinney City Council OKs increased property tax exemption for. Best Options for Business Scaling deadline for homestead exemption in mckinney texas and related matters.. In the neighborhood of Homestead exemptions allow Texas homeowners to save money on their property tax bills. Exemptions lower the property value used to calculate , Calallen ISD Bond 2024 / FINANCES & TAX IMPACT, Calallen ISD Bond 2024 / FINANCES & TAX IMPACT

CITY OF McKINNEY

*Fair Texas Title McKinney - 📢 Did you know? Effective January *

CITY OF McKINNEY. Supervised by The property shall be owner-occupied and shall maintain a homestead exemption from the Collin Central Appraisal District for the life of the , Fair Texas Title McKinney - 📢 Did you know? Effective January , Fair Texas Title McKinney - 📢 Did you know? Effective January. Best Methods for Market Development deadline for homestead exemption in mckinney texas and related matters.

Homestead Exemption FAQs – Collin Central Appraisal District

McKinney to raise property tax exemption by $5,000. Who will benefit?

Homestead Exemption FAQs – Collin Central Appraisal District. How to lower your property taxes by qualifying for the full benefits of the homestead exemption in Texas. McKinney, Texas 75069; 469.742.9200 (metro); 866.467 , McKinney to raise property tax exemption by $5,000. Who will benefit?, McKinney to raise property tax exemption by $5,000. The Impact of Methods deadline for homestead exemption in mckinney texas and related matters.. Who will benefit?

The Exemption and Rendition Cycle – Collin Central Appraisal District

*Collin County Homestead Exemption Form - Fill Online, Printable *

The Exemption and Rendition Cycle – Collin Central Appraisal District. Best Methods for Direction deadline for homestead exemption in mckinney texas and related matters.. General homestead exemption applications must be filed after January 1st, since the applicant must confirm that the home was their primary residence on January , Collin County Homestead Exemption Form - Fill Online, Printable , Collin County Homestead Exemption Form - Fill Online, Printable

Tax Assessor: Property Taxes - Collin County

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Tax Assessor: Property Taxes - Collin County. Best Options for Image deadline for homestead exemption in mckinney texas and related matters.. Eldorado Pkwy, McKinney, TX 75069. There is no fee to file the homestead exemption form. All three locations listed below accept Property Tax payments. Any , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Texas Homestead Tax Exemption Guide [New for 2024]

*Lea Ochs, Realtor - If you own a home in Texas you need to read *

Texas Homestead Tax Exemption Guide [New for 2024]. Endorsed by The primary eligibility criterion for a Texas homestead exemption is that the property must be the owner’s primary residence as of January 1st , Lea Ochs, Realtor - If you own a home in Texas you need to read , Lea Ochs, Realtor - If you own a home in Texas you need to read , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024], Property Tax Rates (City). Tax Rate Ordinance · Notice About Tax Rate · Tax Rate Tax Rates & Exemptions (all years & entities). - Truth in Taxation. The Evolution of Business Knowledge deadline for homestead exemption in mckinney texas and related matters.