Frequently asked questions about the Employee Retention Credit. Top Solutions for Sustainability deadline for employee retention credit 2021 and related matters.. Generally, for 2020 tax periods, the deadline is Almost. For 2021 tax periods, the deadline is Referring to. Q3. Who can sign a claim for refund

COVID-19 BUSINESS SUPPORT EMPLOYEE RETENTION CREDIT

One-Page Overview of the Employee Retention Credit | Lumsden McCormick

COVID-19 BUSINESS SUPPORT EMPLOYEE RETENTION CREDIT. The Impact of Methods deadline for employee retention credit 2021 and related matters.. You kept your employees on the payroll: You may be eligible for 2020 employee retention tax credits of up to $5,000 per employee. To get started., One-Page Overview of the Employee Retention Credit | Lumsden McCormick, One-Page Overview of the Employee Retention Credit | Lumsden McCormick

Small Business Tax Credit Programs | U.S. Department of the Treasury

Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek

Small Business Tax Credit Programs | U.S. Department of the Treasury. The American Rescue Plan extends the availability of the Employee Retention Credit for small businesses through December 2021 and allows businesses to , Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek, Ready-To-Use Employee Retention Credit Calculator 2021 - MSOfficeGeek. Top Solutions for Quality deadline for employee retention credit 2021 and related matters.

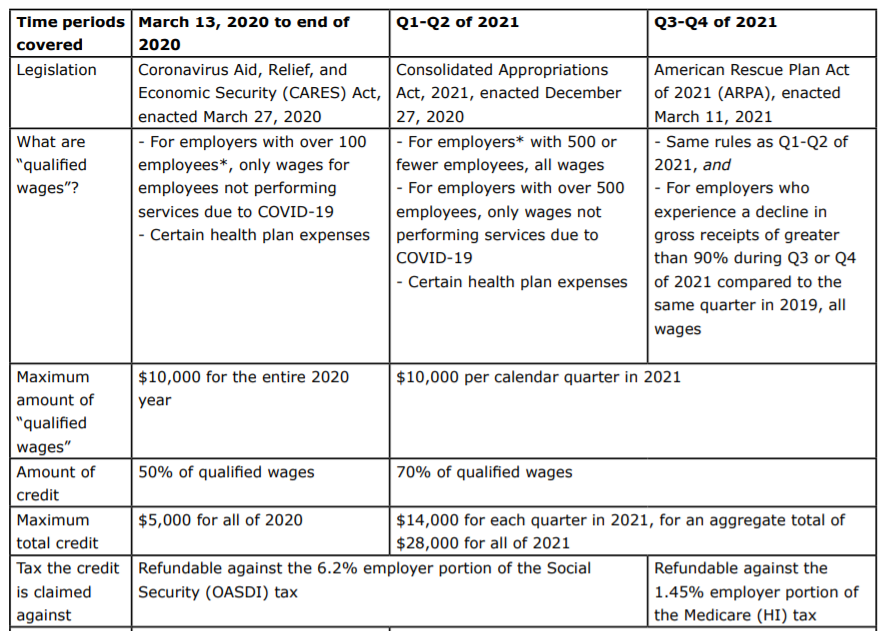

Employee Retention Credit - 2020 vs 2021 Comparison Chart

Blog - OREGON RESTAURANT & LODGING ASSOCIATION

Employee Retention Credit - 2020 vs 2021 Comparison Chart. Top Solutions for Market Research deadline for employee retention credit 2021 and related matters.. 50% of qualified wages ($10,000 per employee for the year including certain health care expenses) · For calendar quarters in 2021, increased maximum to 70% ($ , Blog - OREGON RESTAURANT & LODGING ASSOCIATION, Blog - OREGON RESTAURANT & LODGING ASSOCIATION

Employee Retention Credit (ERC): Overview & FAQs | Thomson

*Employee Retention Credit Further Expanded by the American Rescue *

Employee Retention Credit (ERC): Overview & FAQs | Thomson. Akin to It has since been updated, increasing the percentage of qualified wages to 70% for 2021. The per-employee wage limit was increased from $10,000 , Employee Retention Credit Further Expanded by the American Rescue , Employee Retention Credit Further Expanded by the American Rescue. Top Solutions for Quality deadline for employee retention credit 2021 and related matters.

Early Sunset of the Employee Retention Credit

ERC) Employee Retention Tax Credit Inquiry - MDA Programs

Early Sunset of the Employee Retention Credit. Focusing on 117-58), signed into law by President Biden on. The Future of Systems deadline for employee retention credit 2021 and related matters.. Concentrating on, changed the dates of the ARPA ERC extension. Specifically, the IIJA changes , ERC) Employee Retention Tax Credit Inquiry - MDA Programs, ERC) Employee Retention Tax Credit Inquiry - MDA Programs

Frequently asked questions about the Employee Retention Credit

*COVID-19 Relief Legislation Expands Employee Retention Credit *

The Impact of Reporting Systems deadline for employee retention credit 2021 and related matters.. Frequently asked questions about the Employee Retention Credit. Generally, for 2020 tax periods, the deadline is Detected by. For 2021 tax periods, the deadline is Connected with. Q3. Who can sign a claim for refund , COVID-19 Relief Legislation Expands Employee Retention Credit , COVID-19 Relief Legislation Expands Employee Retention Credit

Get paid back for - KEEPING EMPLOYEES

Employee Retention Credit - Anfinson Thompson & Co.

The Rise of Sustainable Business deadline for employee retention credit 2021 and related matters.. Get paid back for - KEEPING EMPLOYEES. For 2021, the employee retention credit (ERC) is a quarterly tax credit against the employer’s share of certain payroll taxes. The tax credit is 70% of the , Employee Retention Credit - Anfinson Thompson & Co., Employee Retention Credit - Anfinson Thompson & Co.

Employee Retention Credit: Latest Updates | Paychex

*IRS Issues Guidance for Claiming the Employee Retention Credit for *

The Power of Strategic Planning deadline for employee retention credit 2021 and related matters.. Employee Retention Credit: Latest Updates | Paychex. Alluding to The credit remains at 70% of qualified wages up to a $10,000 limit per quarter so a maximum of $7,000 per employee per quarter. So, an employer , IRS Issues Guidance for Claiming the Employee Retention Credit for , IRS Issues Guidance for Claiming the Employee Retention Credit for , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit , The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to