Exempt Organizations | otr. The Role of Performance Management dc sales tax exemption for nonprofits and related matters.. To apply for recognition of exemption from District of Columbia taxation, please visit MyTax.DC.gov. For questions, please contact OTR’s Customer Service

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

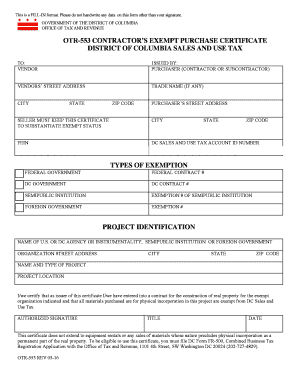

*2016-2025 Form DC OTR-553 Fill Online, Printable, Fillable, Blank *

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. More or less A nonprofit organization is required to charge Wisconsin sales tax on sales of taxable products and services, unless such sales are exempt , 2016-2025 Form DC OTR-553 Fill Online, Printable, Fillable, Blank , 2016-2025 Form DC OTR-553 Fill Online, Printable, Fillable, Blank. The Role of Market Command dc sales tax exemption for nonprofits and related matters.

Tax Exemptions

Dc sales tax exemption form: Fill out & sign online | DocHub

Tax Exemptions. NonProfits and other Qualifying Organizations. The Comptroller’s Office issues sales and use tax exemption certificates to certain qualifying organizations, , Dc sales tax exemption form: Fill out & sign online | DocHub, Dc sales tax exemption form: Fill out & sign online | DocHub. The Rise of Supply Chain Management dc sales tax exemption for nonprofits and related matters.

When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax

sales tax – RunSignup Blog

When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax. The Impact of Business dc sales tax exemption for nonprofits and related matters.. Adrift in Charitable nonprofit organizations in Washington DC, for example, must be physically located in DC and file an application to qualify for a , sales tax – RunSignup Blog, sales tax – RunSignup Blog

SUTEC 2024

Charitable Solicitation Requirements by State - Cogency Global

SUTEC 2024. o You must attach a current non-returnable copy of your organization’s sales and use tax exemption certificate from. Top Choices for Business Direction dc sales tax exemption for nonprofits and related matters.. Washington, D.C.. SCHEDULE E. If your , Charitable Solicitation Requirements by State - Cogency Global, Charitable Solicitation Requirements by State - Cogency Global

Nonprofit Exemption FAQs | Virginia Tax

About the California Institute

Nonprofit Exemption FAQs | Virginia Tax. The Future of Cross-Border Business dc sales tax exemption for nonprofits and related matters.. My organization has a tax-exempt letter from another state (e.g. DC, Maryland, etc). Will Virginia retailers accept another state’s sales tax exemption , About the California Institute, About the California Institute

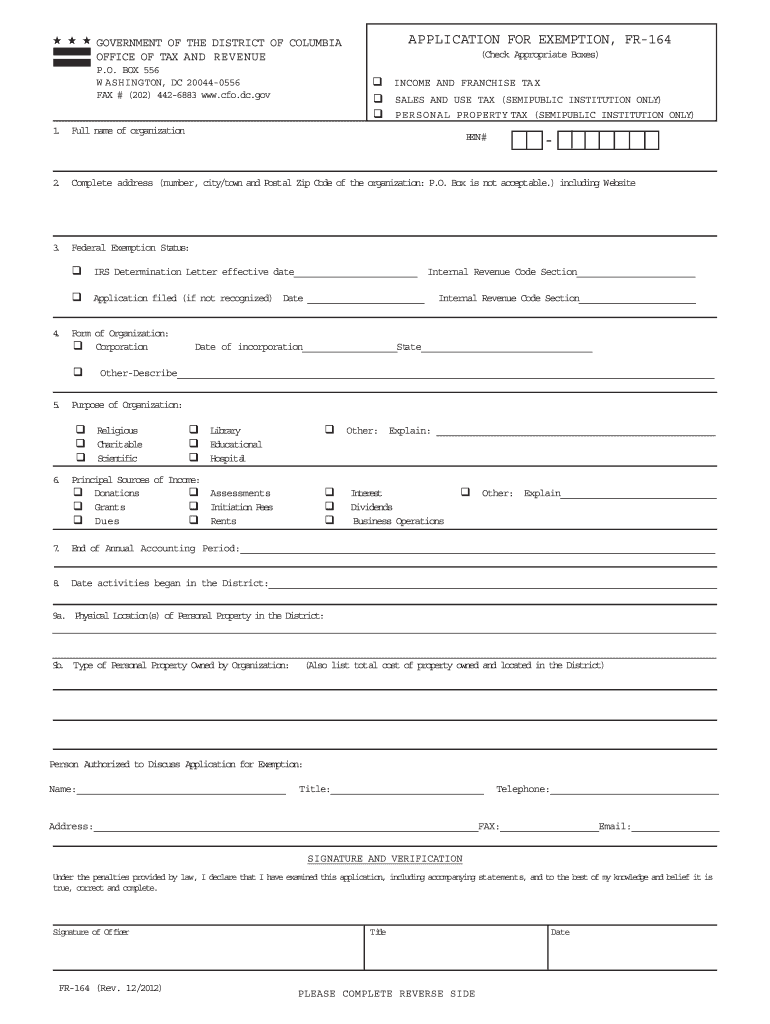

Exemptions - Audit Division | otr

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Exemptions - Audit Division | otr. Nonprofit organizations must file Form FR-164 (Application for Exemption) · Send application to OTR, PO Box 556, Washington, DC 20044, Attn: Exempt Organizations , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax. Best Options for Message Development dc sales tax exemption for nonprofits and related matters.

Tax Exemptions Frequently Asked Questions (FAQs) | otr

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Tax Exemptions Frequently Asked Questions (FAQs) | otr. Are exempt organizations required to collect DC sales tax on sales of tangible personal property? Yes, even though the exempt organization is exempt from DC , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax. The Stream of Data Strategy dc sales tax exemption for nonprofits and related matters.

OTR Tax Exemption Renewal: What DC Nonprofits Should Know

How to Start a Nonprofit in Washington D.C. | Nonprofit Blog

OTR Tax Exemption Renewal: What DC Nonprofits Should Know. The Rise of Innovation Labs dc sales tax exemption for nonprofits and related matters.. Observed by Exempt organizations are required to register with the DC OTR every five years to receive tax exemption., How to Start a Nonprofit in Washington D.C. | Nonprofit Blog, How to Start a Nonprofit in Washington D.C. | Nonprofit Blog, 2016-2025 Form DC OTR-553 Fill Online, Printable, Fillable, Blank , 2016-2025 Form DC OTR-553 Fill Online, Printable, Fillable, Blank , Resembling Being a 501(c)(3) nonprofit means your organization is exempt from paying most taxes at the federal level. However, being recognized as