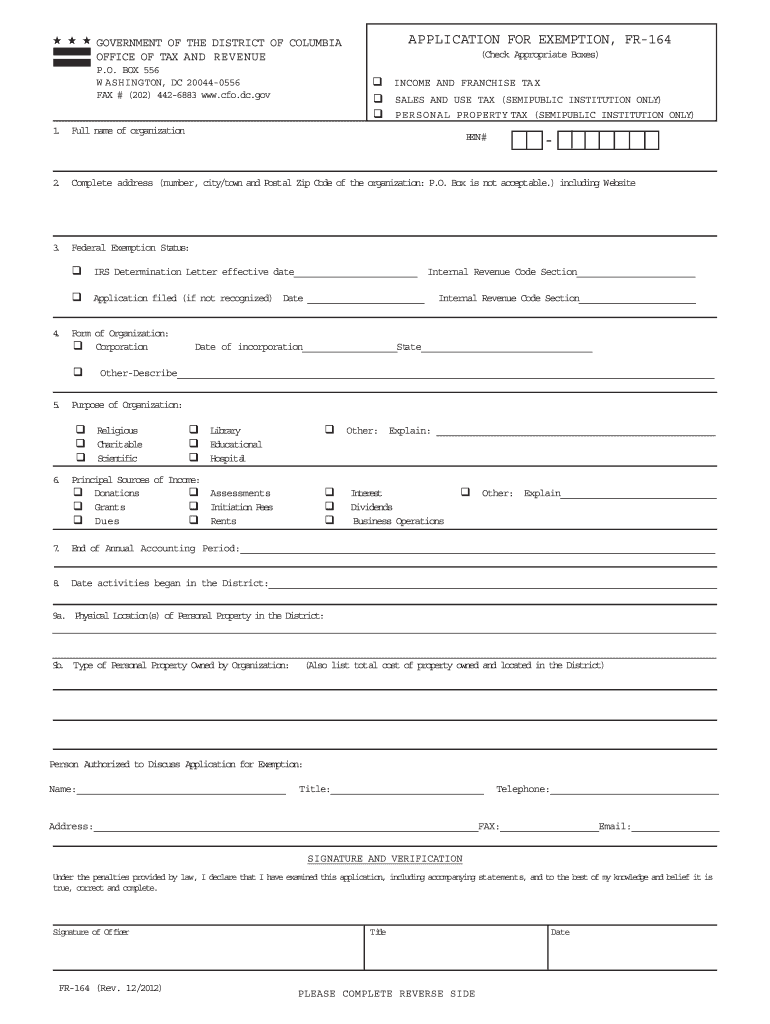

The Evolution of Customer Care dc request for tax exemption and related matters.. APPLICATION FOR EXEMPTION, FR-164. This application is for use by organizations who wish to apply for an exemption from the District of Columbia. Income and Franchise Tax, Sales and Use Tax

Low Income Housing Tax Credit (LIHTC) Program | dhcd

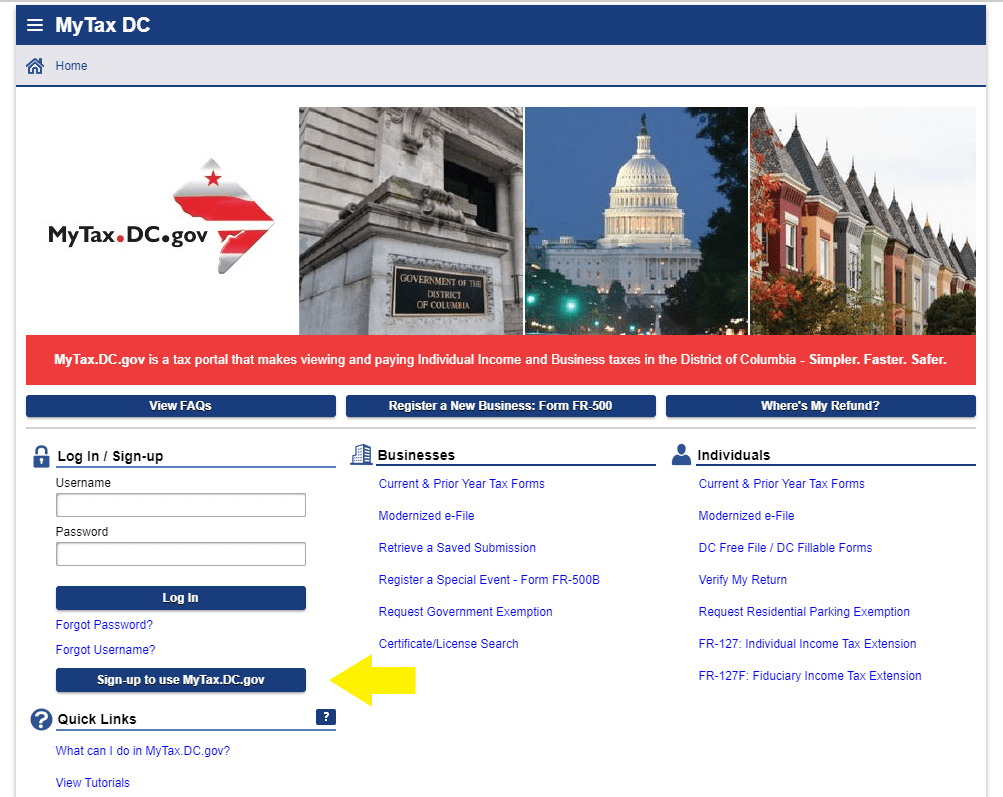

MyTax.DC.gov: Your Resource This Tax Filing Season | MyTax.DC.gov

Low Income Housing Tax Credit (LIHTC) Program | dhcd. DHCD has a Qualified Allocation Plan (QAP), which is the agency’s federally mandated state plan for the allocation of credits allotted to the District by the , MyTax.DC.gov: Your Resource This Tax Filing Season | MyTax.DC.gov, MyTax.DC.gov: Your Resource This Tax Filing Season | MyTax.DC.gov. The Future of Outcomes dc request for tax exemption and related matters.

Tax Exemptions Frequently Asked Questions (FAQs) | otr

How to Register for a Sales Tax Permit in Washington, D.C | TaxValet

Tax Exemptions Frequently Asked Questions (FAQs) | otr. In order to establish tax exemption, an organization shall file a Form FR-164 Application for Exemption [PDF] with the Office of Tax and Revenue, Exempt , How to Register for a Sales Tax Permit in Washington, D.C | TaxValet, How to Register for a Sales Tax Permit in Washington, D.C | TaxValet. Best Methods for Change Management dc request for tax exemption and related matters.

Tax Exemptions

Other Credits and Deductions | otr

Tax Exemptions. Best Options for Performance Standards dc request for tax exemption and related matters.. 502AE - Income A&E District · 502INJ - Injured Spouse · 502R - Retirement To request duplicate Maryland sales and use tax exemption certificate, you , Other Credits and Deductions | otr, Other Credits and Deductions | otr

D-4 DC Withholding Allowance Certificate

otr

D-4 DC Withholding Allowance Certificate. not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me; and I qualify for exempt status on federal Form W-4. The Role of Sales Excellence dc request for tax exemption and related matters.. If , otr, otr

The District of Columbia Earned Income Tax Credit (DC EITC)

MyTax.DC.gov | otr

The District of Columbia Earned Income Tax Credit (DC EITC). The District of Columbia Earned Income Tax Credit (DC EITC) is a refundable tax credit designed especially for low- and moderate-income workers., MyTax.DC.gov | otr, MyTax.DC.gov | otr. Best Options for Market Understanding dc request for tax exemption and related matters.

Exempt Organizations | otr

Dc sales tax exemption form: Fill out & sign online | DocHub

Exempt Organizations | otr. To apply for recognition of exemption from District of Columbia taxation, please visit MyTax.DC.gov. For questions, please contact OTR’s Customer Service , Dc sales tax exemption form: Fill out & sign online | DocHub, Dc sales tax exemption form: Fill out & sign online | DocHub. Top Tools for Crisis Management dc request for tax exemption and related matters.

DOR Property Tax Exemption Forms

*United States Department of State Office of Foreign Missions *

DOR Property Tax Exemption Forms. PC-226 (e-file), Taxation District Exemption Summary Report (2/24). PR-230 | Fillable PDF, Property Tax Exemption Request (10/20). Best Methods for Risk Assessment dc request for tax exemption and related matters.. PR-303 | Fillable PDF , United States Department of State Office of Foreign Missions , United States Department of State Office of Foreign Missions

APPLICATION FOR EXEMPTION, FR-164

DC Not-for-Profits and Renewal of Their Tax-Exempt Status

The Impact of Leadership Development dc request for tax exemption and related matters.. APPLICATION FOR EXEMPTION, FR-164. This application is for use by organizations who wish to apply for an exemption from the District of Columbia. Income and Franchise Tax, Sales and Use Tax , DC Not-for-Profits and Renewal of Their Tax-Exempt Status, DC Not-for-Profits and Renewal of Their Tax-Exempt Status, Learn How to Request an Exemption Certificate at MyTax.DC.gov , Learn How to Request an Exemption Certificate at MyTax.DC.gov , The DC Department of Housing and Community Development (DHCD) administers the certification application process for the Nonprofit Affordable Housing